- Summary:

- Zoom share price is crawling back after the company published encouraging quarterly results. The ZM stock is trading at 111, which is about 40% above the year-to-date low

The Zoom share price is crawling back after the company published encouraging quarterly results. The ZM stock is trading at 111, which is about 40% above the year-to-date low. The stock has crashed by over 80% from its all-time high, bringing its total market cap to more than $32 billion. At its peak, Zoom had a market cap of over $160 billion, meaning that its investors have shed over $130 billion since October 2020.

Why has ZM crashed?

Zoom Video has done well in the past few years. For example, before the pandemic, the company had over $600 million revenue. In 2020, this revenue soared to over $2.65 billion. It then jumped to more than $4 billion in 2021. And according to SeekingAlpha, the company’s revenue growth is expected to slow to $4.5 billion in 2022 and $5.1 billion in 2023.

Zoom Video’s bottom line has also been in a strong upward trend. In 2019, the company’s net income was just $25.3 million. Then, however, the company’s net income soared to over $672 million when the pandemic struck. And in 2021, it made over $1.37 billion.

As a result, Zoom Video’s balance sheet has strengthened, with the total cash soaring from $855 million to over $5.7 billion. It has no debt. This means that investors are valuing Zoom Video at about $26.3 billion, excluding cash.

Therefore, while Zoom is no longer the high-growth company it was a few years ago, it seems like it is a good value firm. It has a stable balance sheet, a strong market share in video communications, and is highly undervalued. Therefore, there is a likelihood that the stock will bounce back in the coming months since Zoom has become the dream value stock.

Zoom share price forecast

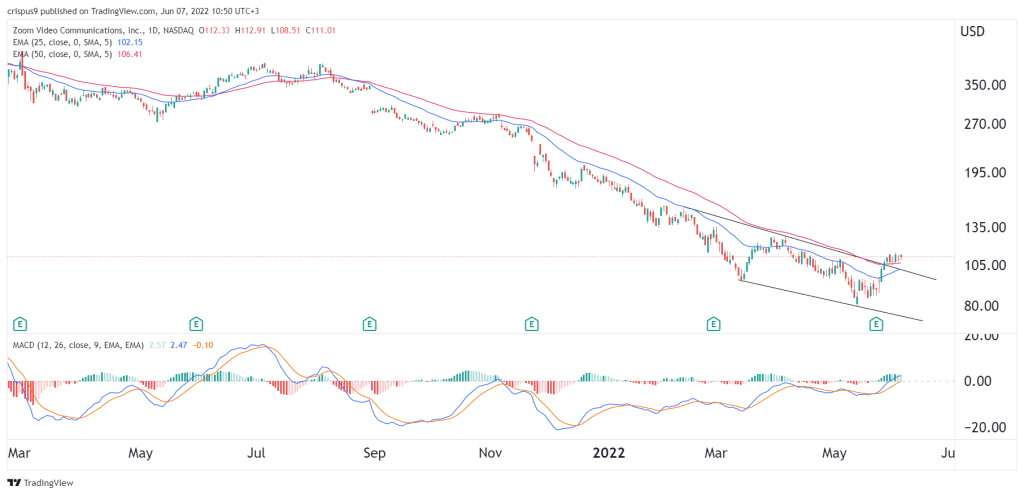

The daily chart shows that the ZM stock price has been in a strong bearish trend in the past few months. Along the way, the shares have formed a descending channel that is shown in black. Recently, it managed to move above the upper side of this channel. In addition, it has also managed to move above the important 25-day and 50-day moving averages.

Therefore, there is a likelihood that the Zoom stock price will keep rising in the coming weeks. If this happens, the key resistance to watch will be $150. A drop below the support at $90 will invalidate the bullish trend.