- Yes Bank share price faces fresh downward pressure after the RBI put hurdles on an acquisition bid. We explore its implications.

Yes Bank share price ended the week on a sour note, going down for the second successive session. The private lender’s stock closed at Rs 23.30, having erased -0.5 percent as the market reacted to news of a collapsed stake acquisition bid by Japan’s Sumitomo Mitsui Banking Corporation (SMBC).

Nonetheless, Yes Bank (NSE: YESBANK) snapped its losing streak on the weekly chart after gaining a modest 0.69 percent in this week’s trading. Japan’s SMBC had expressed interest in acquiring 51 percent of Yes Bank, but news outlets in India reported on Friday that the Reserve Bank of India was against handing over controlling stake to a foreign institution.

India’s government came to the rescue of Yes Bank in 2020 acquiring 48.2 percent stake (later reduced to 23.9 percent) through the State Bank of India and other local banks at a time when the private lender was staring at collapse. SMBC officials visited India last month to negotiate the acquisition.

The Indian government is likely worried about the implications of handing over control of one of the country’s largest private banks to foreigners. Regulatory hurdles placed by RBI will slow down reforms at Yes Bank, to the detriment of the bank’s share price. That said, SMBC could still get a piece of Yes Bank if it agrees to a more diversified approach to the acquisition involving other bidders.

Yes Bank share price prediction

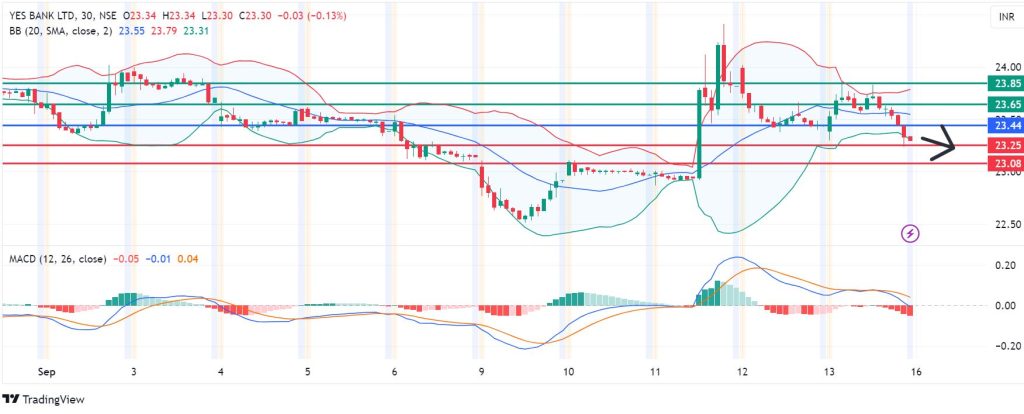

The momentum on Yes Bank share price calls for further downside below the 23.44 pivot mark. That will likely see the first support established at 23.25. However, extended control by the sellers could drive further declines to test 23.08.

On the other hand, the buyers will have the upper hand above 23.44. With the buyers in control, the next resistance could come at 23.65. However, extended control could clear that hurdle, invalidating the downside narrative and potentially mounting the momentum to test 23.85.