- Summary:

- Hopes for stimulus from global central banks causes a return of risk sentiment in Asian session, as Japanese Yen falls and Asan stocks gain.

The Japanese Yen fell against the US Dollar and Asian stocks gained broadly as expectations for renewed stimulus packages from central banks and policy makers caused a brief return of risk sentiment in the markets. Having hit a low of $105.05 in last week’s trading, the USDJPY is presently up to 106.56 as at the time of writing.

Asian stocks also did well in the first trading session for the week on the back of risk sentiment, which has arisen as traders expect central banks to take measures to combat fears of a global economic slowdown. The surge in Asian stocks Monday was led by Hong Kong’s Hang Seng index, which traded up to 26,318 points; a 2.3% increase. This was followed by China’s Shanghai Composite Index, which gained 2.1% to trade at 2,883 points. Modest gains were recorded by Australia’s ASX (0.9%), Japan’s Nikkei 225 (0.7%) and South Korea’s KOSPI (0.7%).

Technical Play for USDJPY

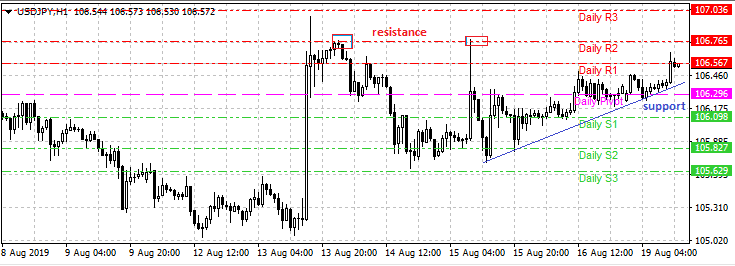

The pair is presently testing the R1 daily pivot and is expected to find resistance at this area or at the R2 pivot (106.76), which is the highest closing price level attained last week. The markets continue to watch for events around the US-China trade war, especially as a decision on whether some relief measures would be given to Huawei this week is being expected.

A close above the R1 pivot would target the 106.76 and 107.03 levels respectively, while a return of risk-off sentiment will see the USDJPY test the 106.29 level. Downside violation of this level and the ascending support trendline on the hourly chart will see the attainment of 106.09 and possibly 105.82, in that order.