- Summary:

- The Fed interest rate announcement could trigger more negative Yearn Finance price predictions if the hike exceeds expectations.

The market is getting set for more Yearn Finance price predictions to the downside as the YFI/USDT pair trades lower by 3.56%. The drop of the day means that the Yearn Finance token has shed more than 40% of its value in six consecutive losing days of trading, as the crypto market endures more selling just ahead of the Fed’s interest rate decision.

A rise in interest rates drives investment flows from the stock and crypto market into the money market instruments. Therefore, the expected 50bps rate hike looks likely to send the YFI/USDT pair lower.

However, some may argue that a 50bps rate hike is already priced in and that the token should start seeing a turnaround after today’s announcement. But what if the Fed decides to go for broke and send rates 75bps higher? This could trigger an explosive drop and generate very bearish Yearn Finance price predictions.

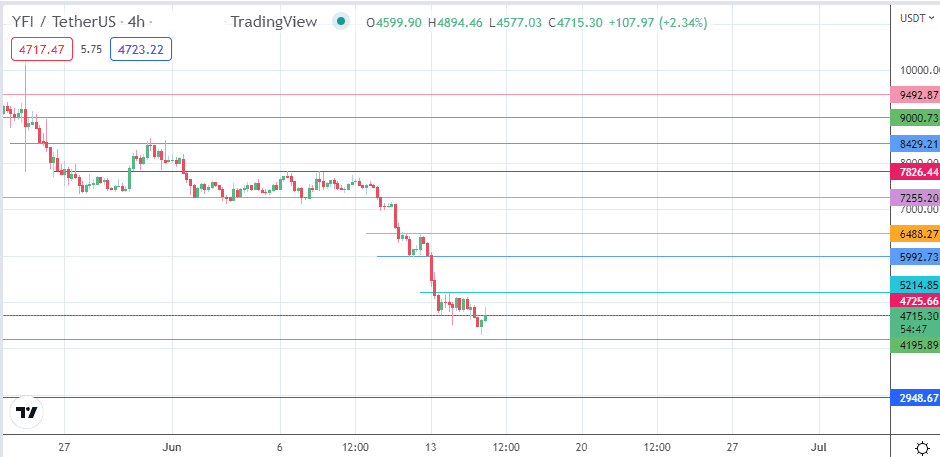

This decentralized platform token is down more than 90% year to date, and while development continues on the asset’s platform, it is clear that the asset has not been the same since the exit of Andre Cronje. So far, the 4725.66 support has held firm despite at least two violations. With the daily candle now forming a hammer on this support, what is the Yearn Finance price prediction?

Yearn Finance Price Prediction

The price action has broken the support at 4742.92, paving the way for a descent to the next downside target at the 4195.89 price mark (15 August 2020 low). Below this level, the 2948.67 price level becomes the additional target to the south.

On the other hand, a recovery move has to come off the bounce on the 4195.89 support, targeting 4725.66 initially. An extension of this advance will take aim at 5214.85, with 5992.73 and 6488.27 (12 June high) serving as additional price targets to the north.

YFI/USDT: 4-Hour Chart