- Summary:

- The Xpeng stock forecast 2022 and 2025 indicate that growth prospects for this Chinese EV maker, barring government interference.

Table of Contents

Intro

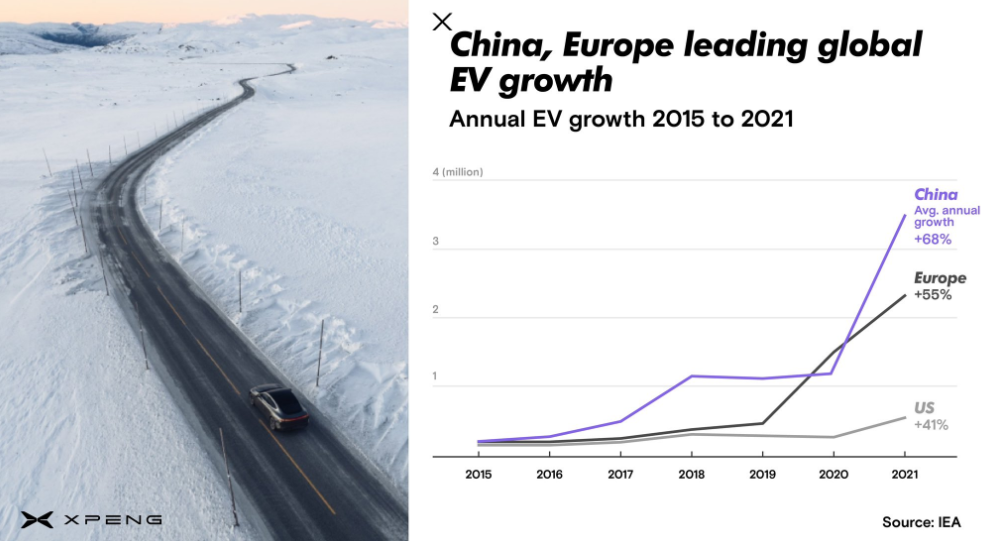

Xpeng is a Chinese electric vehicle start-up company that commenced operations in 2020, securing a listing on the US stock exchange. In 2021, it underwent a dual primary listing in Hong Kong, which was designed to position the stock to benefit from the rebirth of the Chinese EV market.

Xpeng is in direct competition with other Chinese EV brands like Nio and Li Auto. It is also competing with Tesla, which has a powerful imprint in the Chinese market.

Xpeng Stock News

The latest Xpeng stock news indicates that the company has struck sales partnership agreements in Sweden and the Netherlands, continuing its global expansion plans for 2022. Emil Frey Nederland will operate Xpeng’s sales and services network in the Netherlands, while Bilia Stores will handle sales and services in Sweden. An additional retail store will open in Sweden, marking the first retail outlet Xpeng has opened outside of China.

This is the second major news piece about Xpeng following the company’s listing on the Shenzhen Hong Kong Stock Connect. This trading link connects the Hong Kong stock exchange with the Chinese mainland exchange and allows investors on the Chinese mainland to buy the EV maker’s shares. This listing was a bullish trigger for Xpeng as the move has opened up the company’s shares to a broader investor base.

At the time, the Xpeng stock news of the stock’s listing on the Connect carried the stock into the second week of gains, with the asset trading a little above 9% higher at writing. The stock gained 15.8% the previous week, enabling it to recover from a recent dip in the week ended 24 January 2022.

Will Xpeng Stock Go Up?

Will Xpeng stock go up on the back of recent stock fundamentals? The answer to this question is not very straightforward. On the one hand, the fundamentals of the stock look good.

It is the first-ever EV company to be included in the Stock Connect program. President of Xpeng, Brian Gu, believes that this inclusion will diversify the investor base and allow EV tech investors, partners, and others to participate in the company’s growth story.

The growth story referenced by Gu is indeed phenomenal. The company has delivered more than 150,000 EVs in two years of operations. In January 2022, it delivered 12,922 vehicles, representing an increase of 115% over the figures for January 2021.

The company also has a significant order backlog and needs to expand its manufacturing capacity to clear this. This, the company says, indicates that its EV products have strong market demand. So on paper, things are looking good. The stock has added nearly 25% in two weeks of trading from 24 January, despite a slight pullback in the Xpeng stock price today.

However, there are some significant headwinds. The first is the global shortage of microprocessors, which has impacted the entire EV market and not just Chinese EV makers. This factor is likely to limit the ability of Xpeng to clear its backlog and expand its new order base.

Then there is the issue of just how much autonomy the central government in Beijing will allow the company after the 2021 crackdowns on the big tech companies such as Alibaba and Tencent. Those crackdowns showed that the overall interest of the government in Beijing is for companies to grow within the context of serving national interests.

Xpeng Stock Forecast 2022

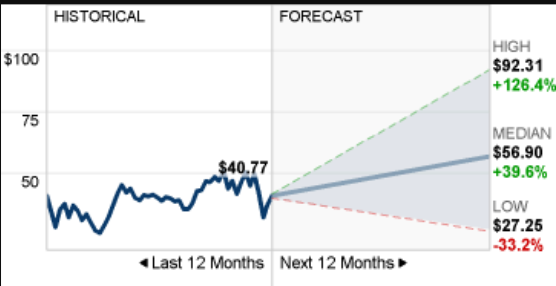

The Xpeng stock forecast 2022 indicates the potential for a short-term stock appreciation, riding on the back of the current fundamentals and the prevailing pattern on the weekly chart. The chart shows that price action is trading within an evolving symmetrical triangle. Following the bounce from the triangle’s lower border, the active candle is now testing resistance at 41.53 (21 December 2021/18 January 2022 lows). The continued ascent of Xpeng depends on the bulls uncapping this resistance, which opens the door towards 51.24 and finally 56.68, where the upper edge of the triangle is found.

The highest price ever attained by Xpeng was on 23 November 2020, at 74.49. Twenty-one analysts currently have a 12-month price target of 56.90, with a high estimate of 92.31. Therefore, if the Xpeng stock forecast for 2022 favours the attainment of the high estimate, the bullish run must take out the triangle’s upper edge and the all-time high for the new target to be actualized.

Xpeng Stock Forecast 2025

What is the Xpeng stock forecast for 2025? Currently, 22 polled analysts have recommended buying Xpeng stock. This rating continues to hold steady as of writing, as the consensus expectation is for Xpeng to attract more investor demand from its latest listing and growth in EV deliveries.

The Xpeng stock forecast 2025 looks positive on paper if the sales growth figures are the basis for such an outlook. The past four quarters have shown a gradual increase in reported sales, with a quarterly 30.22% growth and an annual growth of 248%. However, the key challenge is whether the company can sustain this growth for the next three years.

But what happens to the stock if investors focus purely on earnings? The 3rd quarter 2021 results will be released on 10 March 2022. Earnings numbers have been trending in the negative direction in increasing amounts, while the estimate of analysts is for yearly earnings to be more negative in 2021 and 2022 before driving in a more positive direction in 2023. This may be a dampener in the stock’s growth trajectory.

We believe it is better to wait for the company’s earnings for the 3rd and 4th quarters of 2021 to get a clearer picture of the stock’s price direction into the next three years.

Is Xpeng a Good Stock to Buy?

Xpeng is a good stock to buy for the short term if the investor rides on the current wave of demand from its listing on the Hong Kong Stock Connect trading link and its January annualized delivery numbers. However, the company intends to ramp up its production capacity, and the expenditure on this item may result in negative earnings for the company down the road.

If your focus is short-term, then Xpeng could be a good stock to buy now. However, if the priority for investment is long-term, the investor may decide to ride out the crests and troughs that could arise with a 5-year to 8-year cycle in mind.

Summary

The Xpeng stock forecast presented here is only for guidance purposes. The two-year history of Xpeng is not sufficient to use as a basis for projecting what the company’s stock will do 5-10 years down the road.

However, the company has timed its market entry perfectly, and investors appear to be seeing the dividends in the short term. It is left to see if the projections for the next 12 months in terms of price targets will be met.

The most significant headwind that Xpeng will face in the short term is the global shortage of automotive microprocessors. This factor contributed to a 10% decline in global vehicle sales in 2021 compared to 2019. With shortages predicted to last until mid-2022, Xpeng may find itself in an uphill battle to scale past the $50 mark.

The US House of Representatives has passed a bill to provide funding to boost local production of semiconductor chips. It will take some time to pass this bill into law, make the funding available to producers before the chips hit the market. The impact of this additional funding may take at least 18 months to be fully felt. Therefore, the price action of Xpeng will depend a lot on its vehicle delivery numbers as far as 2022 is concerned.

Xpeng: Weekly Chart

Follow Eno on Twitter.