Crude oil plunged from above $60 per barrel to $57 in late Tuesday trading after US Secretary of State Mike Pompeo hinted that Iran had expressed its desire to negotiate its missile program with the US. This was interpreted as a positive step towards easing of sanctions and ensuring stable oil supply, hence the selloff.

Focus now shifts to the weekly EIA Crude Inventories report to be released later Wednesday. The expectations for this report is there would have been further declines in stockpiles as a result of disruptions in the Gulf Coast from Hurricane Barry. This hurricane did not cause as much destruction as initially feared, so any actual declines may bring about only a temporary rally in crude prices. Declines in crude stockpiles would have to be very steep for crude prices to be remarkably impacted to the upside.

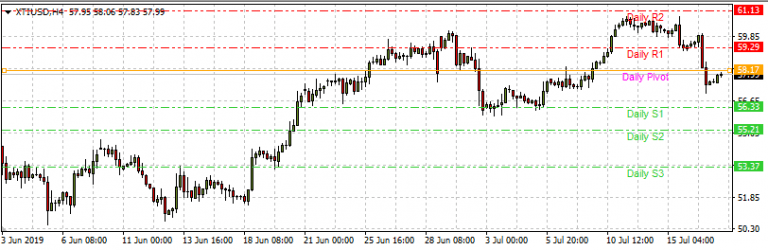

WTI is approaching the daily pivot price of $58.17, which is a price level where crude oil has at various times found resistance (June 21 and July 5) and support (June 25 – 30 and July 15). If crude is able to surmount this resistance, it will target $59.29. This view will be supported on the back of a steep fall in crude inventories which surpasses the market expectation.

On the other hand, failure to breach the daily pivot may see crude selling off once more to the next intraday support level at $56.33 (S1 pivot).Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.