- Summary:

- The fate of the Tullow share price will be determined by the direction of the break from the symmetrical triangle.

The Tullow share price is down 2.19% on the day as investors react to the decommissioning of seven oil wells previously owned by the company in Mauritania.

Tullow has provided the contract for the decommissioning to Petrofac Ltd for a sum of $60m. Petrofac will handle all stages of decommissioning, including project management, planning, well plugging and abandonment on Tullow’s Banda and Tiof offshore fields. The offshore component of the project will last from the 4th quarter of 2022 to the 1st quarter of 2023.

The Tullow share price has had a largely unimpressive run in the last month and has not benefitted from the global rise in energy prices. The company is still trying to recover from an impairment driven loss in its 2021 fiscal year, and is looking to its oil assets in Ghana to initiate a recovery in 2022 and 2023.

Tullow Share Price Outlook

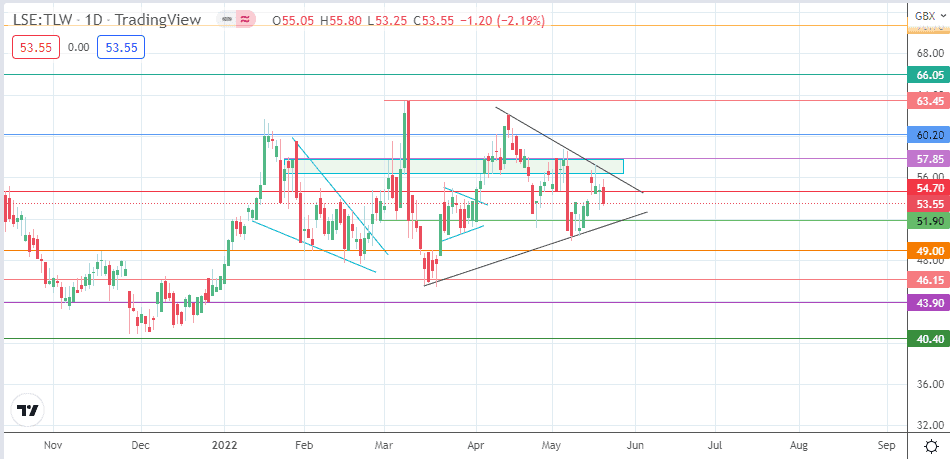

The evolving symmetrical triangle is nearing completion as the price action inches towards the triangle’s apex. The intraday decline has violated the support at the 54.70 price mark (17 May 2022 low). The move sends the Tullow share price closer to the triangle’s lower edge, which also has support from the 51.90 price mark. A breakdown of the triangle follows the degrading of the 51.90 support and the lower edge of the triangle, targeting a measured move at the 43.90 support level (8 November 2021 and 24 December 2021 lows). This move needs to take out the support levels at 49.00 (psychological support) and 46.15 (18 March 2022 low).

On the other hand, a break of the triangle’s upper border and the 57.85 resistance opens the door for a potential move toward the 60.20 barrier. The measured move to the upside should terminate at the 66.05 resistance. This move would require the bulls to uncap the resistance levels at 60.20 and 63.45.

Tullow: Daily Chart