- Summary:

- What are the chances that the Rolls-Royce share price will recover soon? We explain what to expect ahead of Civil Aviation day?

Industrial stocks are not doing well as margin pressures continue. The closely-watched Vanguard Industrials ETF (VIS) has slipped by more than 16% from its all-time high. In addition, the Rolls-Royce (RR) share price has not had a good performance lately. It has dropped to a low of 74p, which was the lowest level since November 6 last year.

Rolls-Royce Holdings shares have fallen by more than 47% from the highest point this year, even after the robust performance of the aviation sector. However, recent results by companies like Southwest, IAG, United Airlines, and American have shown that the sector remains resilient. For example, in its results last week, IAG signalled that it will be profitable for the next two quarters. It also said that business travel was coming back.

Other companies shared these views in the aviation industry. These statements are important for Rolls-Royce share price because the company generates most of its results from the civil aviation sector. Now, investors will focus on this week’s Civil Aviation Day, in which the management will provide more guidance on the sector. The event will happen on Thursday this week. Historically, such events tend to impact a company’s stock.

Rolls-Royce share price forecast

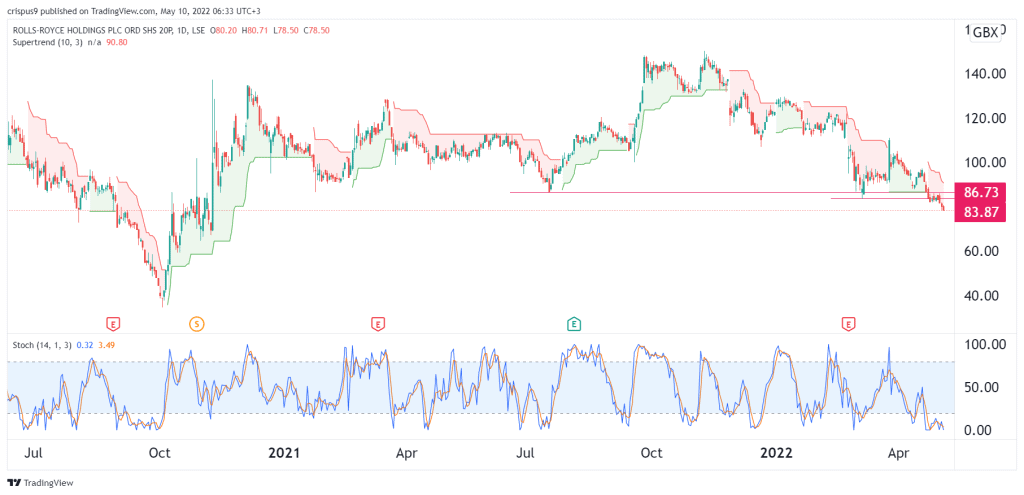

RR was forming a double-bottom pattern in April. The lower side of this pattern was at 83.87. Now, the recent sell-off has pushed the shares below the double-bottom level. It has moved below the Ichimoku cloud, signalling that the bearish trend is still intact. In addition, the supertrend indicator has turned bearish, signalling that bears are still in control.

Additionally, the Rolls Royce share price managed to move below the important support at 86.73, which was the lowest level on June 19th. Therefore, I suspect that the shares will continue to fall, with the next key support level at 70p. On the flip side, a move above the important resistance at 86.73p will invalidate the bearish view.