- Summary:

- The USD Index remains pressured after the CFTC Positioning Report reveals that speculators are still increasing their short positions on the greenback.

The latest consignment of the CFTC Positioning Report indicates that speculators raised their net short positions on the US Dollar. According to data released on Monday, January 4, 2021, by the Commodities and Futures Trading Commission, net shorts on the greenback rose from $30.15 billion to $30.40 billion in the last week of 2020.

This report highlights what has been happening in the currency pairs featuring the greenback as well as the USD Index, where the US Dollar has been on the receiving end. On the USDCHF pair, the greenback has fallen to 6-year lows against the Swissy, and currently sits at 0.88130 as at the time of writing.

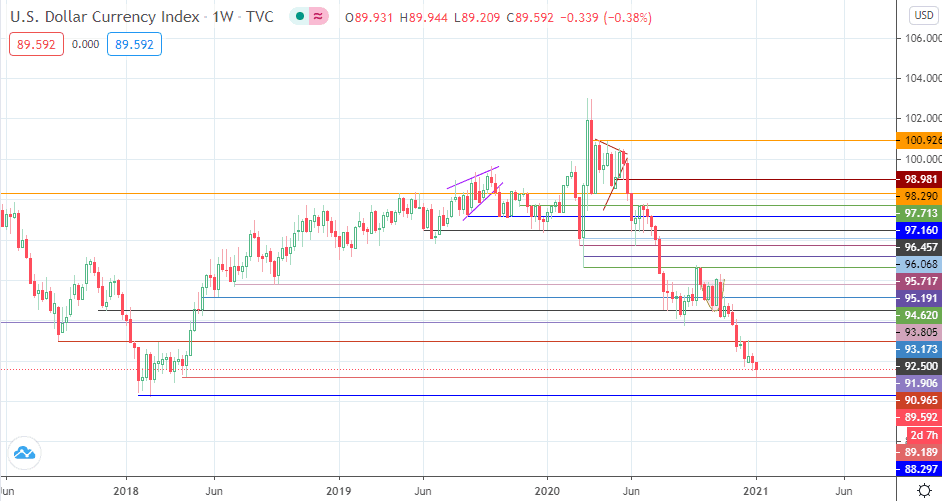

The USD Index is also taking a similar trajectory to the USDCHF, and also sits at 89.650 currently, having touched off multi-year lows at 89.209 earlier in Wednesday’s session.

Technical Levels to Watch

The US Dollar Index may have pared some of its recent losses, but it remains under significant pressure as the greenback remains on offer in the FX market. The 89.189 support (16 April 2018 low) marks the initial downside target for bears, with 88.297 also in the reckoning if the downside persists.

On the flip side, a recovery pullback aims for Monday’s top at 90.965 (26 February 2018 high), with 91.906 and 92.50 also lining up as a potential target to the north.

USD Index Weekly Chart