- What lies ahead of the Tata Teleservices share price? We explain what to expect now that the stock has been in a strong bullish trend?

Tata Teleservices share price has been in a spectacular bull run in the past few years. The NSE: TTML stock is trading at ₹200, about 11,022% above the lowest level in 2020. This makes it one of the best-performing stocks in India. Its market cap has jumped to over ₹390 billion or over $4.89 billion.

Tata Teleservices, also known as Tata Tele Business Services, is a leading Indian company that offers multiple services. The firm provides solutions like cloud and SAAS solutions to businesses. It also offers solutions like collaboration, data services, voice, marketing solutions, and cybersecurity solutions, among others. It is a subsidiary of Tata Group, one of the biggest companies in India.

While the Tata Teleservices share price has been in a strong bullish trend, the company’s revenue has been in a downward trend. Its net income has been in a downward trend. In 2021, the firm had revenue of ₹1,067 crores, down from ₹2,707 crores. Its loss has also widened as the management continues to invest in its growth. The firm’s current liabilities exceed those of its current assets. It has even lost about Rs 21,300 crore in the past two years.

Tata Teleservices share price forecast

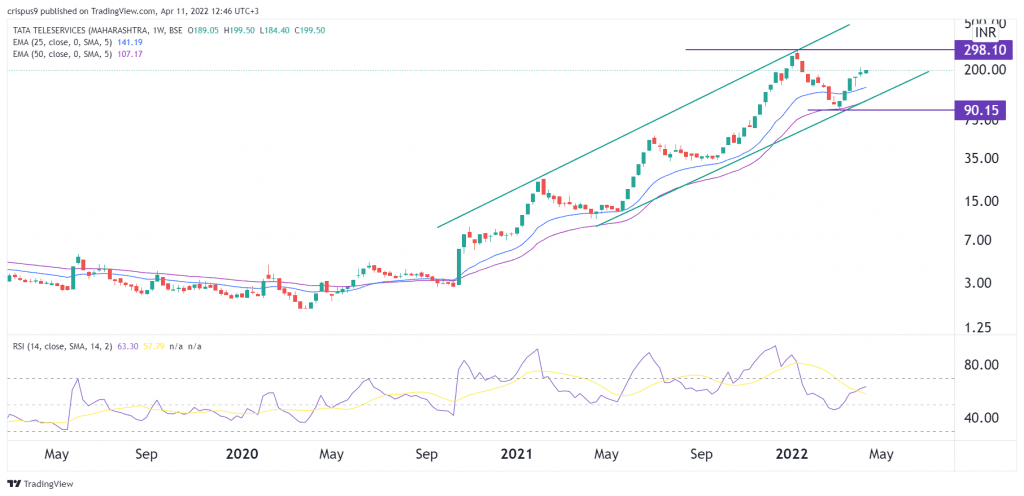

The weekly chart shows that the Tata Teleservices stock price has been in a strong bullish trend in the past few months. As a result, the TTLM stock has been rising and is currently above the 25-week and 50-week moving averages.

The stock has also formed an ascending triangle pattern, and it is currently slightly below its upper side. Its Relative Strength Index (RSI) has moved upwards also. Therefore, while the company seems to have some fundamental issues, it is likely to continue its bullish trend in the near term. This will likely see it rise to the important resistance at its all-time high of 298. A drop below its support at 90 will invalidate the bullish view because it will signal that there are still more sellers in the market.