- Summary:

- The Fresnillo share price strong rebound has hit a barrier as silver and gold prices take a breather. The FRES stock is trading at 721p

The Fresnillo share price strong rebound has hit a barrier as silver and gold prices take a breather. The FRES stock is trading at 721p, which is about 12.45%, which was the highest level last week. Still, the shares are about 18% above the lowest level this year. It has also fallen by more than 15% this year, meaning that it has underperformed other mining stocks like Glencore and BHP.

FRES latest news

Fresnillo is a leading Mexican mining company that focuses on gold and silver. It has operations in places like Fresnillo, Saucito, Herradura, and San Juan. The firm generates annual revenue of over $2.7 billion and a net income of more than $666 million. In a report published last week, Fresnillo said that its pretax profit for 2021 rose by 11% to $611 million as its gold production remained ahead of guidance. Its average price of silver was $24.9 per ounce.

Fresnillo share price has done well in the past few days as investors have focused on the rising gold and silver prices. Gold soared to above $2,000 for the first time in years while silver is trading at $25 per ounce. While the prices have retreated lately, there is a likelihood that prices will remain at elevated levels. The main catalyst for gold prices will be demand from central banks as the de-dollarization trend continues. The Russian central bank is expected to resume its gold purchases in the coming months.

Similarly, after seeing US and other western countries sanction the Russian central bank, there is a likelihood that China’s central bank will keep adding to its purchases. That’s because China is also expected to attack Taiwan soon. Analysts are bullish on Fresnillo share price. For example, those at Citigroup expect that it will rise to 1,100p. Those at Barclays have a forecast of 860p, which is higher than the current level. The average estimate of the stock is 1,100p.

Fresnillo share price forecast

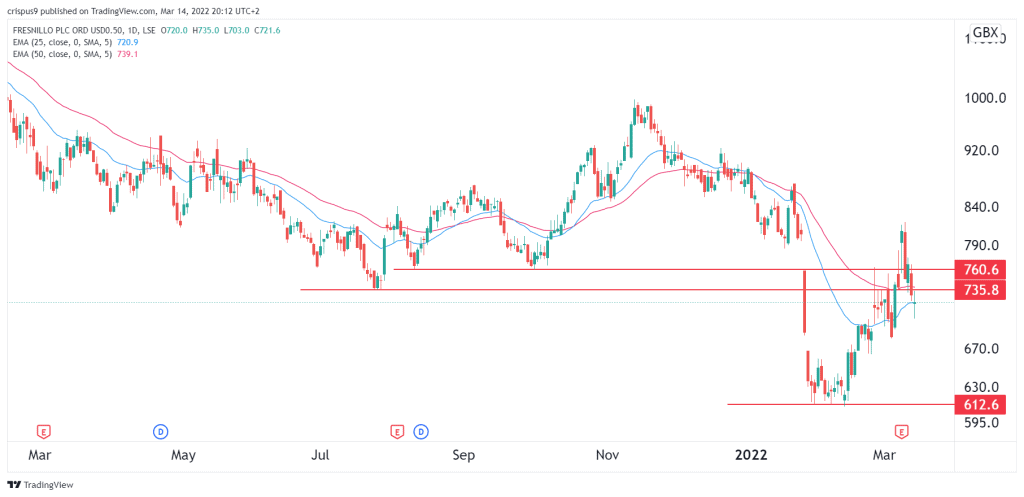

The daily chart shows that the FRES stock price made a bearish breakout on January 26th when it moved below the key support at 735p. This price was along the neckline of the head and shoulders pattern. It then crashed to a low of 612p.

Today, the shares are along the 25-day and 50-day moving averages. Therefore, the outlook of the stock is still bearish, with the next key support level being at 650p. A move above last week’s high at 821p will invalidate the bearish view.