- Here is the Kyber token price prediction as Flurry Finance's rhoToken is listed on the Kyber Direct Market Maker decentralized exchange.

FLURRY Finance intends to make yield farming a more profitable venture for its users. To do this, it has deployed its rhoTokens on the Kyber Network as part of the expansion of its cross-chain integrations.

FLURRY holders can now use the revolutionary Kyber Dynamic Market Maker (KyberDMM), a new pricing solution that enables users to trade and invest in a low-slippage, high-liquidity environment.

A common problem with offloading large volumes of tokens or assets in the financial markets is that transaction costs are usually high, especially when the liquidity is lower. This situation also creates an environment for slippages and bad price fills, which negatively impact the trader.

KyberDMM was built to reduce trading costs, eliminate slippage and make trading more capital efficient, making it a perfect venue for FLURRY’s rhoToken holders to earn interest on their holdings. Holders of the FLURRY tokens can also earn fees by supplying the stablecoin to the liquidity pools provided by KyberDMM, at minimum transaction costs. This situation allows for a symbiotic operation, with the tokens providing liquidity for the exchange and the exchange providing a more liquid and cheaper trading environment with lower slippage.

Benefits to Flurry Users from the KyberDMM

What will be traded on KyberDMM are Flurry’s rhoTokens, which are pegged to the Flurry stablecoin at parity. Flurry’s rhoTokens are rhoUSDT, rhoUSDC and rhoBUSD. You have crypto tokens that can be farmed for interest. When you buy rhoTokens with any of the major cryptos, you earn interest as long as you keep holding the rhoTokens. The interface shows you how much interest you have earned and what you can expect to earn from every rollover cycle.

Flurry’s cross-chain protocol gives the token the ability to be used across different chains and networks. There are additional benefits for FLURRY users. Holders of the FLURRY token can mine other rho tokens such as rhoUSDC, without having to possess to pre-own the stablecoin to be mined. Flurry’s cross-chain capacity eliminates the tedious processes involved in switching from one DeFi project to another.

Initially starting with ERC-20 tokens, Flurry is now branching out into cross-chain connectivity with other networks, with Kyber being one of the initial collaborations. With the Testnet already running, Flurry is now in the stage of integration and implementation of cross-chain interoperability.

About the Kyber Network

The Kyber Network changed the game in decentralized finance with the launch of the dynamic market maker as part of the Kyber 3.0 upgrade. KyberDMM seeks to eliminate the challenges of low capital efficiency and high slippage that besets many popular decentralized exchanges.

The upgrade that brought about the DMM also featured a transition from a single liquidity protocol to a multiple liquidity-protocol platform. It is also an advancement over traditional automated market makers, which are static and do not allow liquidity providers to control the pricing mechanism that traders are served.

The DMM is also an automatic fee-adjuster for liquidity providers, using market conditions to allow LPs to price their assets accordingly. Migration of the native token in the third quarter of 2021 to a newer platform, compliant with the architecture of Kyber 3.0, is in the works.

Here is how the Kyber token is reacting to the latest news regarding this collaboration.

Kyber Price Prediction

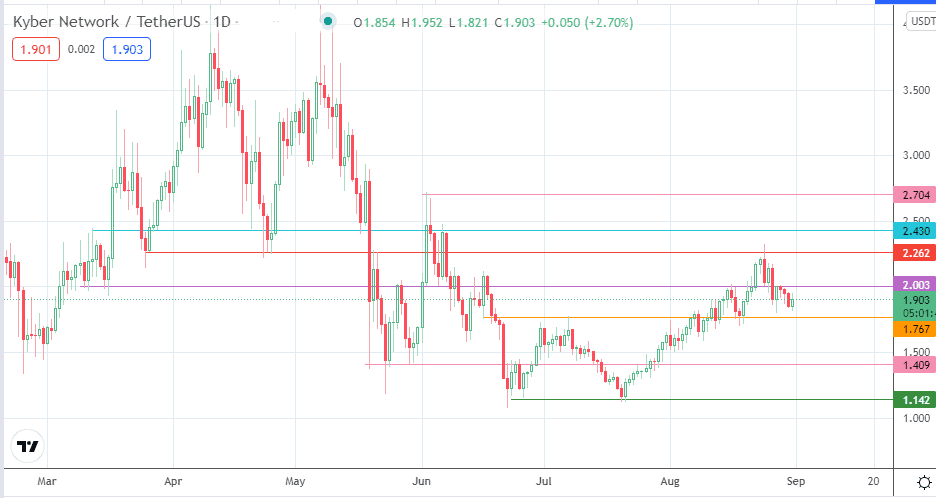

The Kyber token has gained 3.78% this Tuesday as the news of the collaboration with FLURRY Finance hits the newswires. A look at the daily chart of the KNC/USDT pair shows that the Kyber token doubled its value in a one-month run that lasted from July 21 to August 24. Though the token is in a slight correction, there is a lot of upside potential in the token as the Kyber exchange continues to gain traction from projects seeking capital-efficient non-slippage exchanges.

A break above the August 24 high at 2.43 and the June 1 high at 2.713 could provide clear skies for the Kyber token to aim for the 3.00 mark.

Only a breakdown of the 1.76 support allows for more selling which provides a potential dip-buying opportunity at lower prices, with the 1.409 support and 1.142 price mark serving as likely candidates.

Kyber Token Price (Daily) Chart