- Summary:

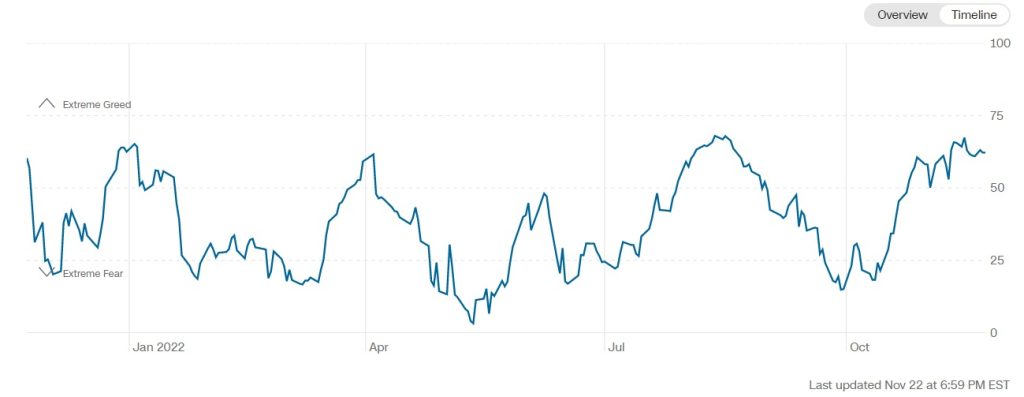

- The fear and greed index has been stuck in the greed zone in the past few weeks as stocks rebound. It has been stuck at 62

The fear and greed index has been stuck in the greed zone in the past few weeks as stocks rebound. It has been stuck at 62, which is significantly higher than last month’s low of 45. This rebound happens as the S&P 500 index has rallied by over 14% from the lowest level this year. Dow Jones and Nasdaq 100 indices have gained by 19% and 12%, respectively.

What is the fear and greed index?

The fear and greed index is one of the most popular gauges in the financial market. It tracks several important indexes that measure the state of the market. It was created by CNN Money to predict the overall sentiment among the market. The index ranges from zero to 100.

The fear and greed index is made up of several key indices that measure different things in the market. First, there is the market momentum, which looks at the performance of the S&P 500 and the 125-day moving average. When it is significantly higher than the S&P 500, it is a sign of more greed. The market momentum was at the fear level at the time of writing.

Second, the stock price strength looks at the net new stocks hitting their 52-week high and lows on the NYSE. A greed level is reached when more stocks are testing their 52-week highs. Third, the stock price breadth looks at the McClellan Volume Summation index.

The other parts of the fear and greed index are put-and-call options, market volatility, and safe haven demand. Market volatility is measured by the VIX index while the safe-haven demand is the difference in the 20-day stock and bond returns

How to use the fear and greed index

The fear and greed is simply a lagging gauge that traders and investors use in the market. It is a lagging gauge since it tends to track the performance of the S&P 500 index. In most cases, the index tends to rise when the S&P 500 index is rising and vice versa.

Therefore, in most cases, investors tend to buy stocks when the fear and greed index moves to the greed area. Indeed, the S&P 500 and the Dow Jones indices have rallied by more than 10% from their lowest points this year.

Still, as a lagging indicator, the fear and greed index can be a bad predictor of the stock market. As such, you should incorporate more tools to predict the market.