- Summary:

- The downfall of Cineworld's Share price started as a rumour, with many speculating that the company would go into bankruptcy.

The downfall of Cineworld’s Share price started as a rumour, with many speculating that the company would go into bankruptcy. However, last week, the company confirmed that it was considering filing for bankruptcy.

The admission by the company caught some by surprise, considering it is the second biggest movie theatre chain which, not so long ago, acquired Regal Cinemas for more than $1 billion. The revelations by the company sent the markets tumbling, and on August 17, the company closed the market down 60 per cent.

Since then, the Cineworld share price has continued to suffer in the markets, and today, being the last day of August, has seen the company’s value being down by 87 per cent for the month. Part of the reason cited for its struggle in the markets was due to its mounting debts, which has made it hard for the company to continue operating. Following two years of disruptions by the pandemic and after staging a disappointing recovery, the company also had a few missteps, including its now failed acquisition of Cineplex.

The collapse of the Cineplex deal resulted in Cineworld being sued and losing the case and being ordered to pay over $1 billion. The case has been among the factors that, looking back, have contributed to the current Cineworld struggles.

Cineworld Share Price Analysis

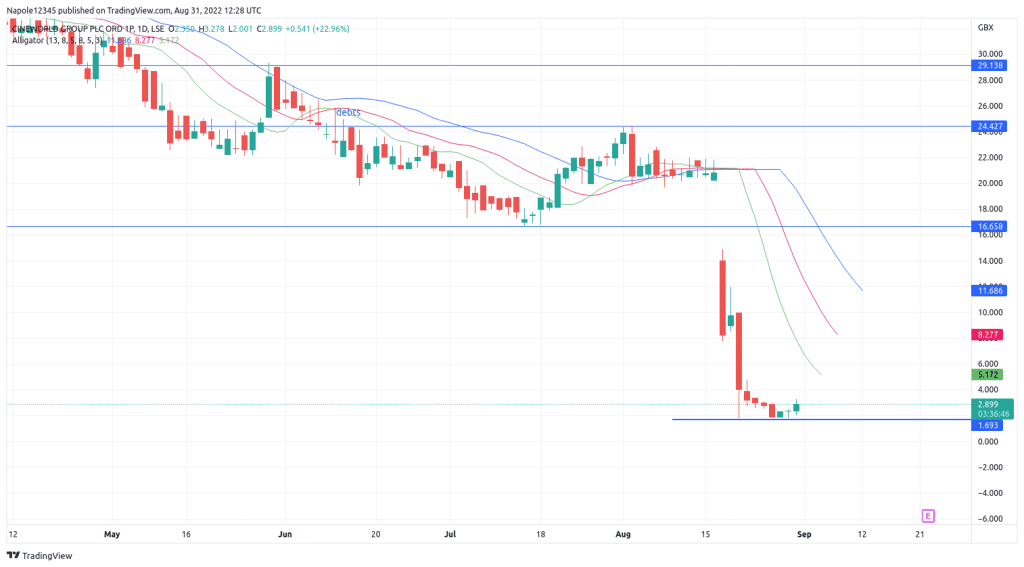

Unfortunately, in my opinion, Cineworld issues are just starting. In September, my Cineworld share price expectations is for the company to continue struggling, There is a high likelihood that we may see a further drop in Cineworld prices.

A trade below the 1.5p price level before mid-September is not out of the question. I expect the current bearish trend to dominate, and during periods where Cineworld is not dropping, my price expectation is for it to trade in a horizontal trend. My analysis will be invalidated only when Cineworld’s share price trades above the 8p price level.

Cineworld Daily Chart