- Summary:

- The FTSE 100 index is up this Tuesday, lifted by a weaker Pound that has cheapened UK stocks, and a rise in UK oil and banking stocks.

The FTSE 100 index is up 1.28% this Tuesday, as a combination of a weaker Pound and solid performances from UK banking and oil stocks lifted the index.

One of the drivers of the rise in the FTSE 100 this Tuesday has been the hammering the Pound has taken due to the cost of living crisis now facing most UK households. A weaker Pound has made it cheaper for foreign investors to buy equities listed in the FTSE 100 index. After last Friday’s hawkish comments of Fed Chair Jerome Powell at the Jackson Hole symposium, the FTSE 100 index fell heavily. But after this round of selling has come renewed buying, with oil stocks BP and Shell being major beneficiaries of this demand as crude oil prices on the Brent benchmark go up on expected production cuts.

Banking stocks on the FTSE 100 index are also seeing fresh demand in anticipation of the Bank of England having to respond aggressively to the steep rise in the UK’s inflation expectations. Barclays is topping the gainers’ chart with a 3.62% increase. Standard Chartered, HSBC Holdings and Lloyds Banking Group are also in green territory.

A decline in British Consumer Credit levels from 1.8 billion pounds in June

to 1.4 billion pounds in July did not impact the index negatively. The consensus came in at 1.5 billion pounds. This decline was not unexpected as the BoE’s interest rate hikes have raised the cost of borrowing. Data from the BoE also show that mortgage lending in the UK has dropped from 5.3 billion pounds to 5.1 billion pounds.

FTSE 100 Index Outlook

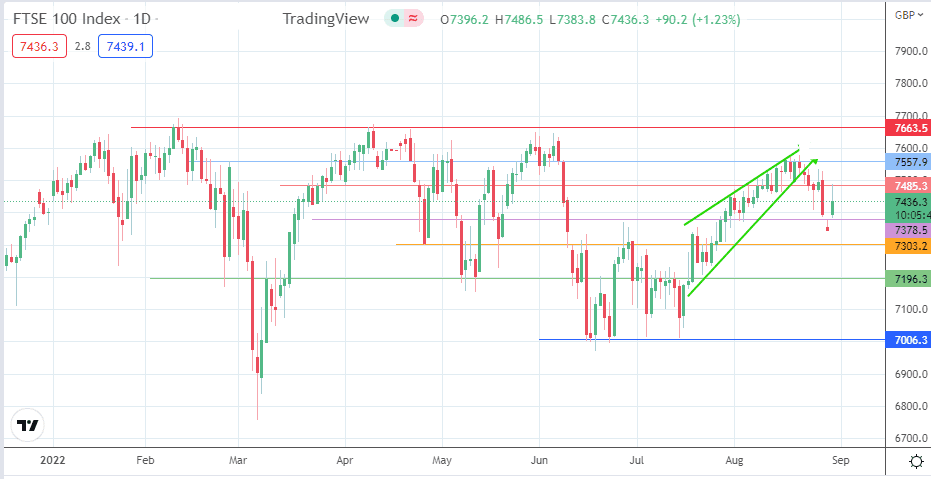

The breakdown of the rising wedge on the daily chart sets up a potential measured move that targets completion at 7303 (26 April and 10 June lows). This move requires the bears to firmly reject the uptick at the 7485 resistance (24 March and 4 August highs in role reversal) and force a breakdown of the 7378 support level (18 May and 3 August lows). If this plays out and there is additional bearish momentum, the 7196 and 7100 psychological price levels become available as new targets to the south.

On the flip side, a break of the intraday high at 7485 paves the way for an attempt at 7557 (9 June and 16 August highs). A further march toward 7663 will depend on the break of 7557. The January/August 2018 highs at 7792 and the May 2018 all-time high at 7903 are the additional targets to the north if the bulls break above 7663.

FTSE 100: Daily Chart