- Summary:

- The Watches of Switzerland share price has been in a strong recovery in the past few weeks as demand for its products rise.

The Watches of Switzerland share price has been in a strong recovery in the past few weeks as demand for its products rise. WOSG stock rose to a high of 880p, which was about 22% above the highest level this year. The company has a market cap of over 2 billion pounds.

Watches of Switzerland Group earnings

Watches of Switzerland is one of the biggest watch sellers in the UK and other countries. The firm has partnerships with the leading watch-makers like Rolex, Patek Philippe, Swatch Group, Richemont, LVMH, and other independents. It sells these watches on its website and outletS of stores in key cities in the UK, US, France, and Italy among others.

Watches of Switzerland said that its revenue rose by 25% from 297 million pounds in 2021 to 391 million pounds. It attributed this strength to the performance in the UK as showrooms reopened. Luxury watches revenues rose to 342 million pounds while its revenue in the US rose to over 152 million. The firm has been increasing its marketing spend in the country.

Watches of Switzerland’s also reiterated its guidance for the year. It expects that its revenue will be between 1.45 billion and 1.50 billion pounds. Further, the company’s adjusted EBIT will be between 157 million and 169 million pounds. The firm’s CEO said:

“We continue to focus on attracting new clients and growing market share in the UK and US. We have seen positive early results from our expansion into Europe. As we continue to invest in our multichannel model and new incremental projects, we remain confident in our long range plan.”

Watches of Switzerland share price forecast

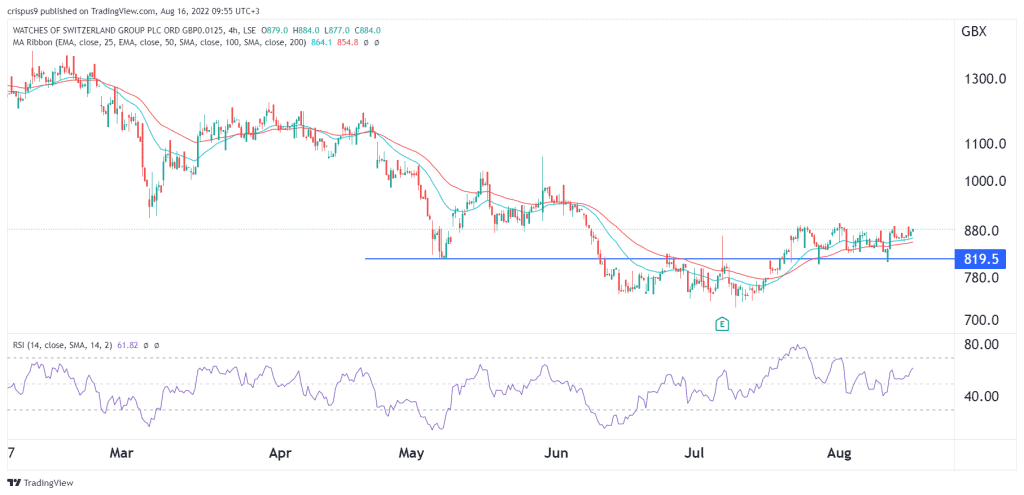

The four-hour chart shows that the WOSG share price has been in a strong bullish trend in the past few weeks. The rebound accelerated when the stock rose above the key resistance at 819p. It rose above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) moved above the neutral point. It has also formed an inverted head and shoulders pattern.

Therefore, the shares will likely continue rising as bulls target the next key resistance level at 1,000p. A move below the support at 819p will invalidate the bullish view.