- Summary:

- The Warner Bros Discovery share price has crashed hard in the past few weeks. We explain whether WBD is a good stock to buy.

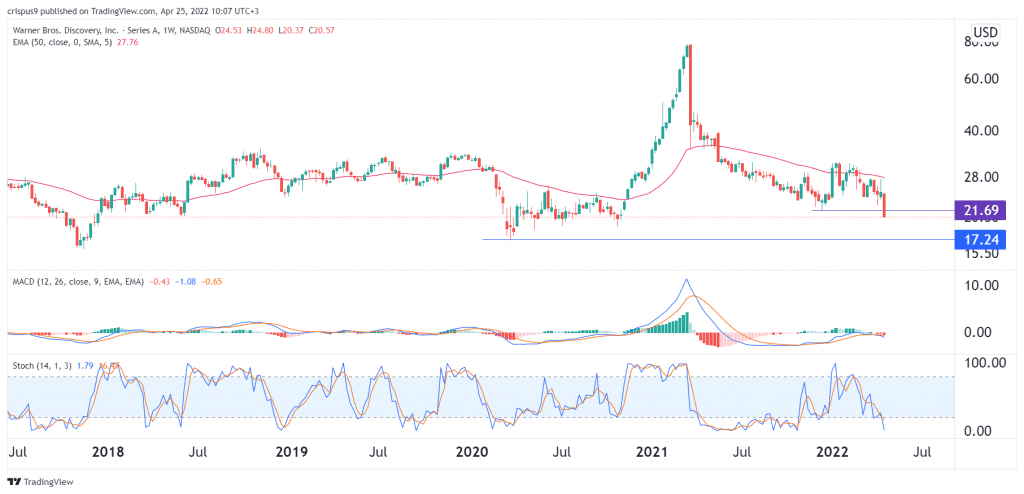

The Warner Bros Discovery share price has crashed to the lowest level since November 2020. The WBD stock is trading at 20.57p, which was about 73% below the highest level in March this year. As a result, its total valuation has slipped to about $53 billion, meaning that investors have lost over $7 billion in the past few days.

WBD latest developments

The Warner Bros Discovery stock price has been under pressure in the past few days. There are several catalysts why the stock has crashed. First, the shares have dropped significantly as investors worry about the streaming industry following the disappointing Netflix earnings published last week. The company announced that it had lost subscribers as competition in the sector continued.

Therefore, investors believe that other streaming stocks will continue struggling. Besides, Netflix stock price has already crashed by over 45% in the past three months and 57% in the past 12 months. As a result, its market capitalisation has dropped to about $95 billion, which is a remarkable downfall since it was valued at over $300 billion.

Warner Bros Discovery share price also dropped after the company decided to cancel CNN+. In a statement, the firm said that it would add some of the content on the platform to HBO Max. Some analysts believe that the cancellation was a good thing for the firm as it tries to implement over $3 billion in savings in the next few years.

Further, the WBD stock price has dropped even after the positive results from AT&T last week. In a statement, AT&T said that HBO and HBO Max had gained over 3 million subscribers in Q1 even as Netflix lost users.

Warner Bros Discovery share price forecast

We see that the WBD stock price has been in a strong bearish trend in the past few weeks on the weekly chart. The stock managed to move below the important support level at $21.70, which was the lowest level on December 13th. It has also moved below the 25-week and 50-week moving averages. At the same time, the MACD and the Stochastic

Oscillator have moved to the oversold level. Therefore, the Warner Bros Discovery share price will likely keep falling in the near term as investors abandon streaming stocks. If this happens, the next key support level will be at $20.