- Summary:

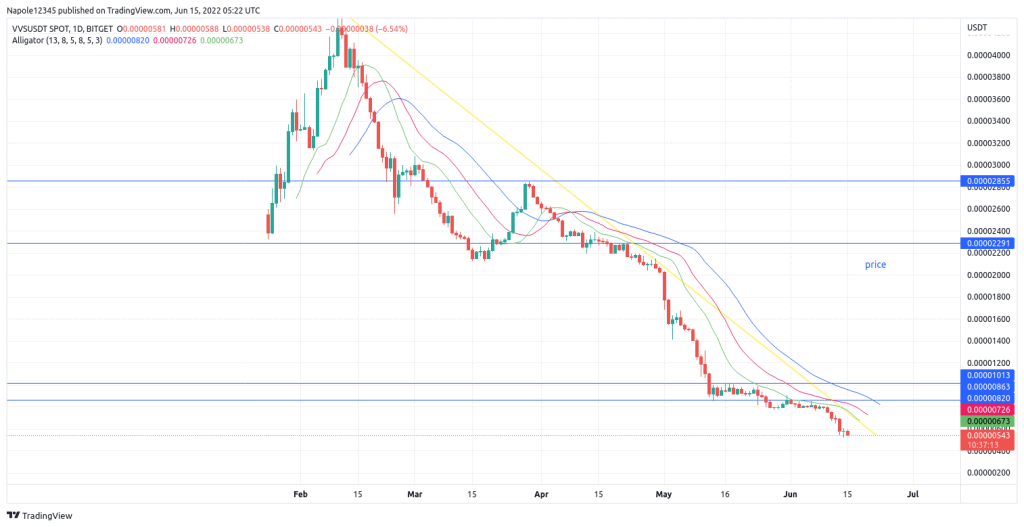

- VVS Finance price is in a long-term bearish trend that has seen the crypto lose 36 percent of its value this month.

VVS is down 6 per cent today and has been setting new price lows for the past few weeks. VVS has closed the markets with a price loss in six of the past seven trading sessions.

VVS Finance Struggle in the markets

VVS has continuously performed dismally for the past few months. VVS Finance is down 36 per cent this month, and the strong bearish trend appears set to continue. The price drop in June is also a continuation of a long-term trend that saw the crypto losing 57 per cent of its value in May and 23 per cent of its value in April.

Looking at the year-to-date data, VVS Finance has also lost 83% of its value. The 2022 price loss has been a continuation of a long-term trend that started on November 24, 2021, when VVS Finance reached its all-time price high of $0.0001549. Since then, the cryptocurrency has lost 96.46% of its value, and the drop is looking likely to continue throughout the year.

The above price history is an indication that, although 2022 has been a rough year for the cryptocurrency industry, VVS finance struggles go beyond the current market forces. There is a high likelihood that the current price drop in VVS finance has been due to investors jumping ship and investing in other new projects. This can be seen when comparing the trading volumes of the cryptocurrency over time. In the past 24 hours, VVS Finance’s trading volume has dropped by 60 per cent totalling around $1.7 million. Such a drastic change can have an impact on the markets.

VVS Finance Price Prediction

VVS Finance has continuously set new price lows this year. In today’s trading session, prices are down by 6 per cent. The bearish trend also looks very aggressive and is likely to continue the bearish trend throughout the session. Therefore, my VVS finance price prediction expects the prices to continue falling. As a result, there is a high likelihood that we will see prices trading below the $0.000050 price level in the next few trading sessions.

However, should the prices close above today’s opening price of $0.0000581, my bearish analysis will be invalidated. It will also mean a likely bull move in the offing.

VVS Daily Chart