- Summary:

- Our VVS Finance price prediction is on its way to flipping bullish as the price has broken out of the downtrend.

Our VVS Finance price prediction is on its way to flipping bullish as the price has broken out of the downtrend. The bearish Bitcoin price action this week has slowed down the momentum as the price got rejected from the $0.0000068 level. Nevertheless, the VVS crypto price is still 20% up from its 9th June low and now trading at $0.0000058.

VVS Finance is a DeFi protocol and an automated market maker (AMM) that resides on the Cronos blockchain of Crypto.com. VVS token is the native asset of the platform that can be earned by the users. However, due to the prevailing risk-off approach in the market, the VVS Finance TVL is down by 60%.

As per DeFi Llama, the protocol TVL is down to $667 million from its February all-time high of $1.46 billion. One major reason for this decrease is the abrupt price decrease in the prices of most cryptocurrencies during this period. The ongoing Bitcoin slump has sent most altcoins into a downward spiral.

According to official VVS Finance news, the platform has been integrated into Zapper Studio. After this integration, users can now track their VVS balances on the Zapper dashboard.

VVS Finance Price Prediction

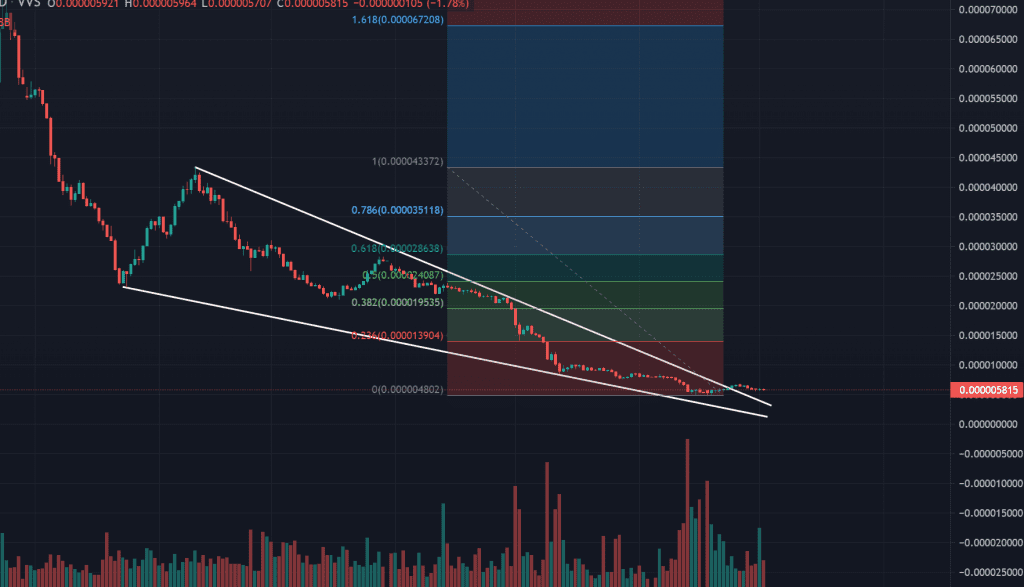

Technical analysis of the VVS Finance coin shows that the cryptocurrency has been in a severe downtrend since its rejection from the $0.0000433 level. This rejection was followed by an intense sell-off that took the price to the recent low of $0.0000049. Nevertheless, the coin has managed to break out of the downwards trendline for the first time in 4 months.

If the Bitcoin price shows some signs of a recovery then VVS Finance crypto can enjoy a relief rally. In such an event VVS Finance price prediction of $0.0000195 seems to be valid. This target also matches the $0.382 Fib retracement level, connecting the February high to the June low.

However, it is also worth mentioning that any fresh lows for Bitcoin might trigger another bearish leg for VVS Finance. Therefore, it is highly recommended to keep a stop loss at the recent low of $0.0000049.

VVS USD Daily Chart