- Summary:

- Since its launch, VVS finance has spent most of its time in a bearish trend. In today's trading session, the crypto is down by 1 percent

Since its launch, VVS finance has spent most of its time in a bearish trend. In today’s trading session, the crypto is down by almost a percentage point, with a high likelihood of the prices moving further down by the end of the session. However, today’s price drop is a continuation of a sideways trend that has resulted in the past six days seeing alternating bearish and bullish moves depending on the previous session.

Today ranked as the 35th largest decentralized exchange platform, VVS Finance remains committed to increasing the rate of crypt trading in the mainstream. However, the goal to grow the platform has come under intense pressure following the recent cryptocurrency, which has led to many investors and traders reducing the amount they are willing to trade with. In the past 24 hours, data shows that trades taken through the platform amounted to $8 million. This is an 11 per cent decline, a pattern that has been seen throughout the month. The decline in trading volume on the platform and the drop in the amount of transactions carried out using VVS may contribute to the current price drops in the market.

VVS Finance Price Prediction

Since reaching its all-time high on November 24, a few days after the project was launched, VVS Finance has been stuck in a bearish move that has resulted in a 93 per cent price drop. This month, VVS Finance has continued with the aggressive downward trend losing 53 per cent of its value.

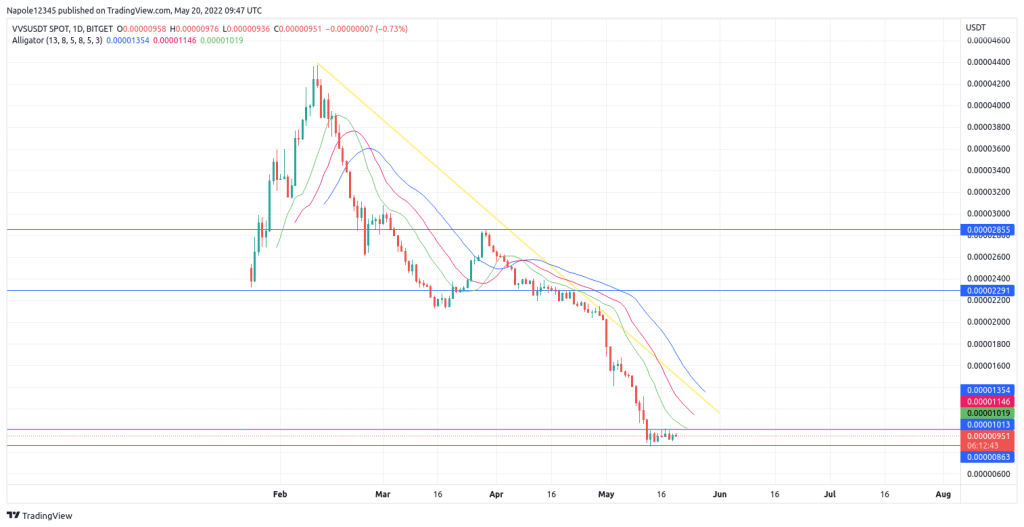

Looking at the chart below, we can see the prices are still in a long-term bearish trend. Furthermore, the Williams Alligator indicator also shows strong signals of the downward move. This is despite the last six days being in a sideways market. Therefore, I expect the price of VVS Finance to continue dropping. As a result, there is a likelihood that we will see the crypto trading below the $0.0000080 in the next few trading sessions.

However, should today’s session close above $0.00001, then my trade analysis will be invalidated. Today, there will also be a high likelihood of a bullish move continuation after closing above the opening price.

VVS Finance Daily Chart