- What next for the VOO stock price as the fear and greed index remains in the extreme fear level? We explain what to expect.

The VOO stock price has been wavering in the past few days as investors reflect on multiple factors. The Vanguard S&P 500 index is trading at $400, which is a few points below this week’s high of $405. It is about 6% above the lowest level in February, while the fear and greed index has moved to the extreme fear zone of 22.

VOO is a giant ETF that tracks the performance of the S&P 500 index. In the past few weeks, the index has been under pressure for several reasons. First, investors are worried about the Federal Reserve. In his testimonies to Congress this week, Jerome Powell hinted that the bank would take a more aggressive stance to deal with inflation. He even hinted that a 50 basis point hike could come as soon as this month.

VOO latest news

Second, the VOO stock price has been unease because of the ongoing crisis in Ukraine. The biggest worry, for now, is that Russia could become the first major economy to default on its debt obligations. In addition, Fitch warned that the country could miss payments this month because of the ongoing sanctions. As a result, the country has been excluded in almost everything ranging from sports to movie releases.

Third, there are concerns that the surging oil prices will affect margins of the S&P 500 index constituent companies. Indeed, the most recent quarterly results showed that many companies are seeing significant margin pressure. All these explain why the fear and greed index has crashed to 22, the lowest point in weeks.

VOO stock price forecast

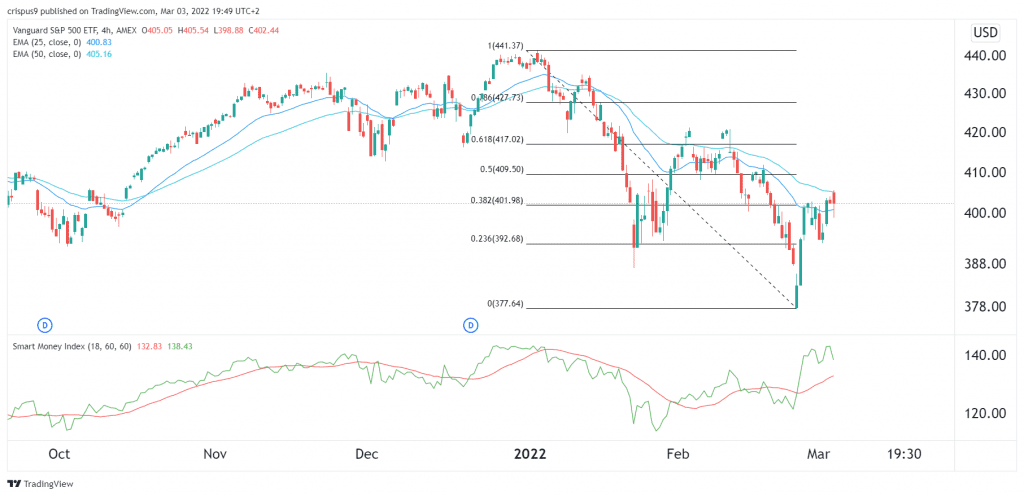

The four-hour chart shows that the VOO share price has cautiously bounced back from its lowest level in February. As a result, the stock has managed to move slightly above the 38.2% Fibonacci retracement level. It has also moved to the 25-day and 50-day moving averages, while the Smart Money Index has moved to the highest level in weeks.

Therefore, there is a likelihood that the VOO ETF will resume the bullish trend as investors price in the ongoing risks. If this happens, the next key level to watch will be at $417, which is along with the 61.8% retracement level.