- Summary:

- The Vodafone share price is up this Tuesday, but could face significant headwinds soon if the company fails to close any new deals.

The Vodafone share price is up this Tuesday, enabling the stock to recover from the recent declines. Tuesday’s 0.77% price uptick comes as bullish sentiment returned to the UK stock market after Monday’s broad selloff.

However, there are signs of emerging headwinds for the Vodafone share price. Reports from London Times indicate that investors want the company to expedite action on deals it had promised to make to override its most significant competition. Activist institutional investor Cevian Capital has also picked up a stake in Vodafone and is now using the new voice it has acquired to push for major changes within the company. Despite the company pursuing deals in several markets, none have been finalized, and investors are impatient.

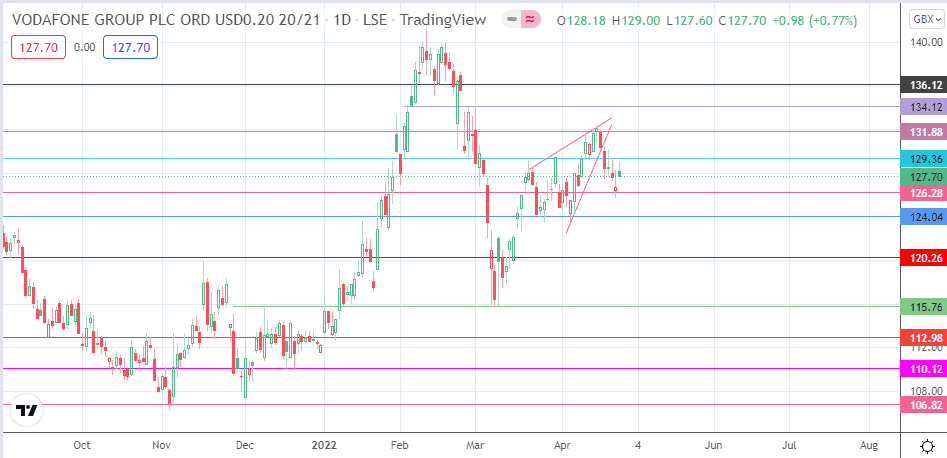

Technically speaking, the emergence of a rising wedge pattern on the daily chart now threatens the recovery attempt after the stock had plummeted from 140p in mid-February to 115p in March 2022.

The company’s German operations is also under scrutiny after it was revealed before erstwhile CEO Hannes Ametsreiter’s departure that the company lost 3,000 broadband subscribers between October and December 2021 while adding only 43,000 new ones in the entire year. The underperformance of this division did not go unnoticed, with Vodafone Group CEO Nick Read having some harsh words of criticism for the German division in a first-quarter trading update.

So how will the Vodafone share price respond?

Vodafone Share Price Outlook

The rising wedge breakdown on the daily chart resulted in a decline below the 129.36 support (30 March and 22 April lows). This decline was truncated at the 126.28 support (18 March low), resulting in a bounce that led to Tuesday’s upside move. However, the active daily candle shows that the bears are fighting back. If the bulls fail to breach the 129.36 price mark (now acting as resistance in role reversal), the 126.28 support becomes vulnerable. If the bulls fail to defend this level, the stage will be set for a decline towards 124.04 (26 January and 24 March lows). If this support yields to bearish pressure, 120.26 (6 September 2021 low) becomes the next support.

Conversely, a break above the 129.36 resistance opens the door toward the 131.88 barrier (11/19 April highs). If the advance continues beyond this barrier, the 136.12 resistance (4 February 2022 high) becomes the next northbound target. There is a potential for the 4/25 February highs at 134.12 to form a pitstop along the way towards 136.12.

Vodafone: Daily Chart

Follow Eno on Twitter.