- Summary:

- What is the outlook of the Vodafone Idea share price after rising sharply in the past few days? We explain what to expect.

The Vodafone Idea share price tilted upwards after the cautious earnings by one of its leading shareholders. The IDEA stock is trading at 9.40, about 15.85% above the lowest level last week. However, the shares are still about 45% below the highest level last year. Its market cap stands at about 296 billion INR.

Why is VOD stock rising?

Vodafone Idea is a leading telecommunication company that is headquartered in Mumbai. The company provides a number of services such as prepaid, postpaid, international roaming, smartphone retail, and data, among others. It is mostly owned by the government, which owns about 35.8% stake in the firm. Vodafone Group has a stake of 28.5%. Aditya Birla Group has a 17.8% stake, while the public owns about 17.90%.

The main catalyst for the Vodafone Idea share price is the decision by Etisalat to acquire a large stake in Vodafone Group. It bought a stake of over $4.4 billion in the firm. Another reason is the latest results by Vodafone Group. The company’s revenue rose from 43.8 billion euros in FY21 to 45.58 billion in FY22. In addition, its operating profit rose to 5.66 billion euros. In a statement, the company’s CEO said:

Our organic growth underpinned a step-change in our return on capital, which improved by 170bps to 7.2%. So whilst we are not immune to the macroeconomic challenges in Europe and Africa, we are positioned well to manage them, and we expect to deliver a resilient financial performance in the year ahead.”

These results came a few days after Vodafone Idea published its quarterly results. The firm’s revenue rose by 5.4% to Rs. 102.4 billion. Its Average Revenue per User rose to Rs. 124 while its total comprehensive loss totalled over Rs. 72 billion.

Vodafone Idea share price forecast

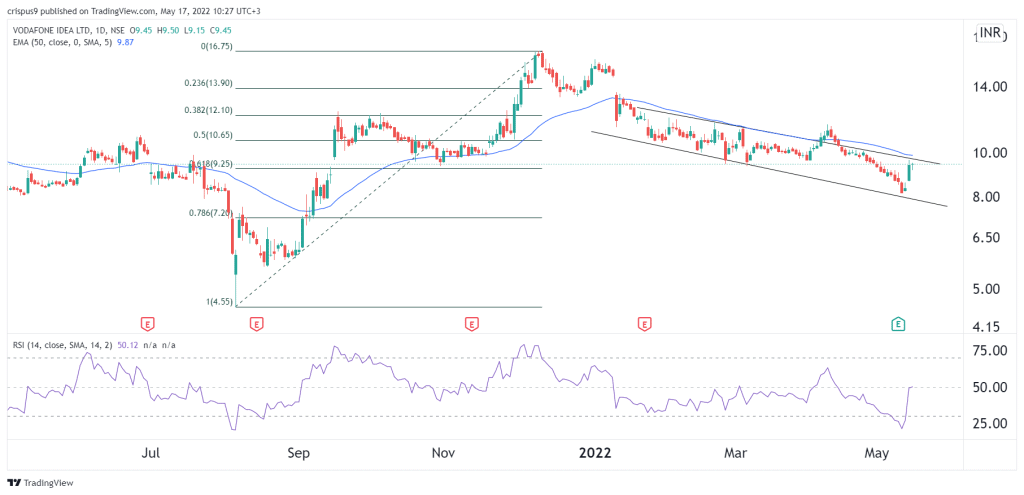

We see that the IDEA share price has made a strong recovery in the past few days on the daily chart. On the daily chart, we see that the stock has moved close to the upper side of the descending channel. However, it is still slightly below the 25-day moving average.

The stock has also moved slightly above the 61.8% Fibonacci retracement level, while the Relative Strength Index (RSI) has moved to the neutral level at 50. Therefore, the stock will likely resume the downward trend as investors target the lower side of the channel at around 8. However, a close break above the resistance at ten will invalidate the bullish view.