- Summary:

- VeThor price went parabolic in the overnight session as traders pumped the token. VTHO rose to a high of $0.0020

VeThor price went parabolic in the overnight session as traders pumped the token. VTHO rose to a high of $0.0020, which was the highest point since June 10th of this year. It then quickly pulled back to $0.0015 in a classic pump and dump scheme. Its market cap stands at $80 million while VeChain is value at over $1.77 billion.

What is VeThor?

VeThor is an important part of the VeChain ecosystem. For starters, VeChain is a blockchain project that is widely used by several large conglomerates in China. It is a platform that simplifies their supply chain by tracking goods across the cycle. Some of the top companies that use VeChain are BMW and Walmart.

VeChain has also expanded its business to other key industries like DeFi and NFTs although it faces substantial competition in them. VET is the native token for the network. On the other hand, VeThor, which stands for VeChainThor Energy is the energy token that powers the ecosystem. It is used to pay gas for all transactions.

The VTHO price jumped sharply in what I believe was a pump and dump scheme. This is where traders publish enthusiastic comments about the token hoping to profit as more people buy. Indeed, a quick look at social media platforms like Twitter, StockTwits, and Reddit shows that the token was trending for a while.

Most importantly, this pump happened in a period when other cryptocurrencies like Bitcoin and Ethereum were also bouncing back.

VeThor price prediction

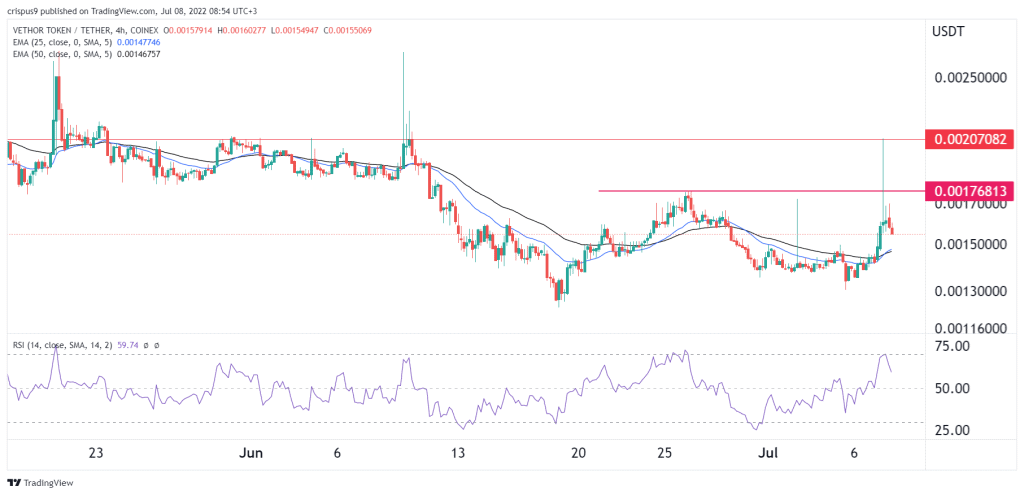

The four-hour chart shows that the VTHO price went parabolic and reached a high of $0.0020. It then quickly collapsed by 25% to the current level of $0.00156. It managed to cross the important support level at $0.0017, which was the highest point on June 26th. The RSI has also pointed downwards.

Therefore, there is a possibility that the VeThor price will continue falling as sellers target the next key support at $0.0015. A move above the resistance at $0.0017 will signal that there are still more buyers in the market.