- Summary:

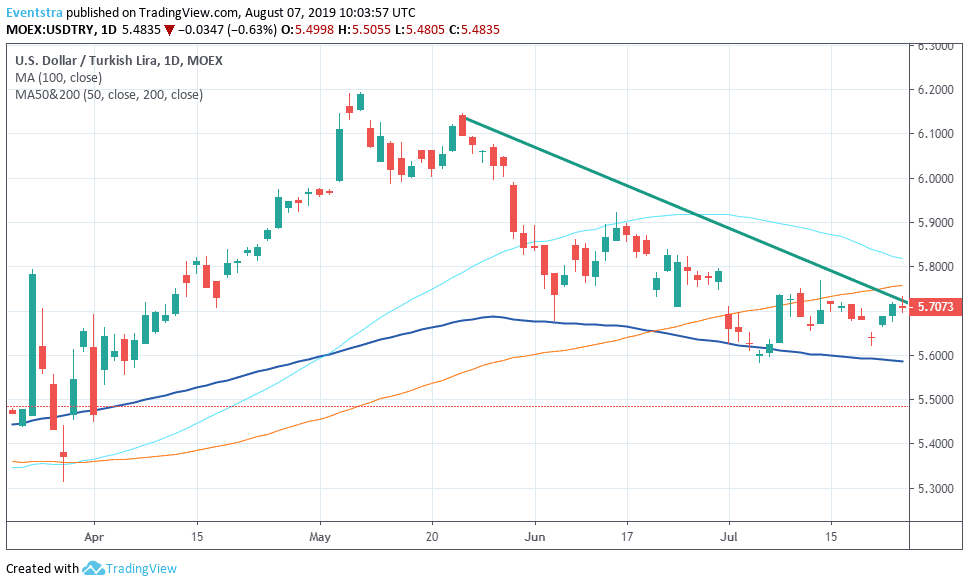

- USDTRY gives up over 0.60 and continues the retreat for sixth consecutive day reaching five month lows. On the technical side the USDTRY will find support

USDTRY gives up over 0.60 and continues the retreat for sixth consecutive day reaching five month lows despite Turkey’s Central Bank (CBRT) cut the one-week repo auction rate by 425 basis points to 19.75% from 24% last week. This was a more aggressive rate cut than market expectations.

Fitch Downgraded Turkey to junk status, and warned of deteriorating independence and economic policy credibility after President Erdogan removed Cetinkaya as his central bank chief last week. Governor Cetinkaya, whose term was due to 2020, was replaced by deputy Murat Uysal, who was the deputy governor for three years and is one of the more dovish members of Policy Committee.

On the technical side the USDTRY will find support at 5.3449 the low from March 25th while more bids will emerge at 5.1950 the low from February 4th. On the upside first resistance stands at 5.5704 the 50 day moving average, then at 5.7228, the 200 day moving average. The outlook is negative on Turkish lira for the long term due to fragile domestic environment and as President Erdogan supports further interest rate cuts, USDTRY eventually will move above the 6 mark.