- Summary:

- USDTRY gives up 0.30% today at 5.6461 at monthly lows as it continues the correction from fourth consecutive session. Turkey Foreign Arrivals figures

USDTRY gives up 0.30% today at 5.6461 at monthly lows as it continues the correction from fourth consecutive session. Turkey Foreign Arrivals figures came up to 17.17% for August from previous 16.7%.

Last week OECD revised the forecast for Turkish economy to -0.3% this year. From – 2.9%. On the other hand, it did not change the projection for 2020 and expected the Turkish economy to grow by 1.6%. Turkey’s unemployment rate rose to 13% in June from 10.2%.

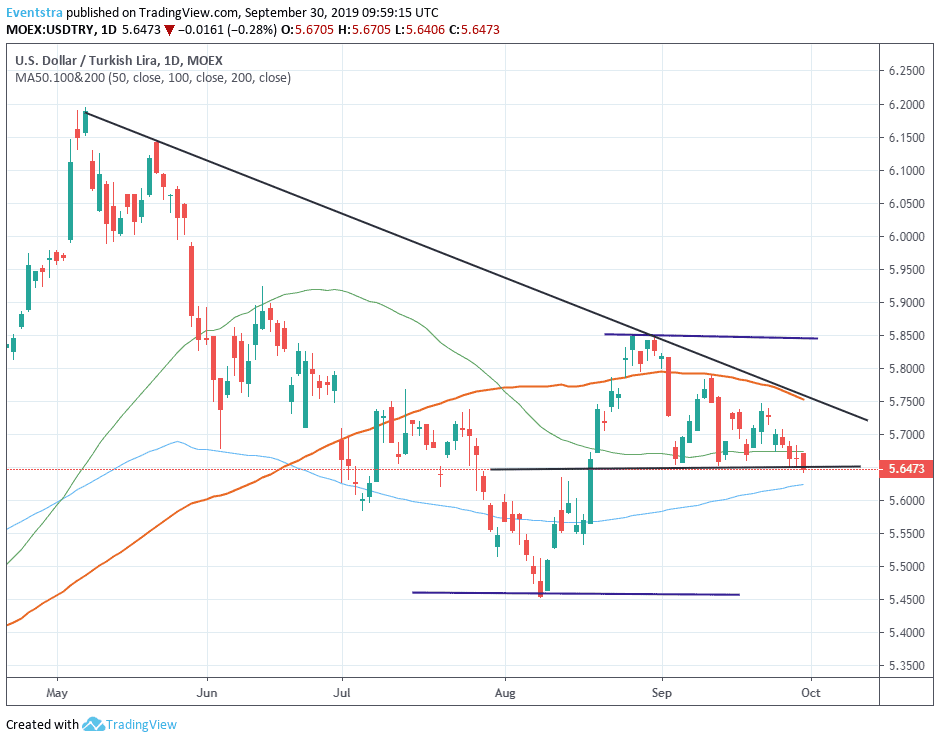

CBRT delivered a 325 bp interest rate cut to 16.50% more than markets expected. Markets were expecting 300 basis points interest rate cut from 19.75%. Tayyip Erdogan has put pressure on central bank (CBRT) to cut interest rates as he wants rates to be back in single digits. The bull run from 5.45 recent lows (August 8th) stopped at 5.85, a zone where the pair rejected three times since August 27th. The pair accelerated the upward move after the price pierced the descending trendline from May 23rd.

Download our Gold Prices Q4 Outlook Today!

[vc_single_image image=”14654″ img_size=”medium” alignment=”center” style=”vc_box_rounded” onclick=”custom_link” img_link_target=”_blank” link=”https://news.investingcube.com/q4-global-market-outlook-eurusd-gold-crude-oil-bitcoin-sp-500/”]On the technical side, the pair breached the 200-day moving average and now the recent bearish momentum might gain traction for a test of the next support at 5.6234 the 50-day moving average; immediate support stands at 5.6406 the daily low. On the upside first resistance stands at 5.6705 today’s high, then at 5.6735 the 200-day moving average which now has turned into resistance, while more offers will emerge at 5.7525 the 100-day moving average.