- Summary:

- The USDTRY is on offer after the CBRT held rates steady at 17.00% in its first monetary policy meeting for 2021.

The Turkish Lira gained strength for the 3rd straight session after the Central Bank of the Republic of Turkey (CBRT) left the interest rates unchanged at 17.00%. Further adding to the weakness of the USDTRY was the prevailing bearish sentiment on the greenback, as inflows pour into emerging market currencies with higher interest rates.

The CBRT decided to keep the One-Week Repo Rate unchanged at 17.00%, which met the market consensus. In making this decision, the CBRT noted that the Turkish economy was recovering at a solid pace. However, the CBRT expressed concerns about the high inflation.

So far, the CBRT’s efforts have helped the Lira pare some of the 2020 losses against the US Dollar. Also boosting the Lira today was an improvement in Consumer Confidence in January from 80.1 to 83.3.

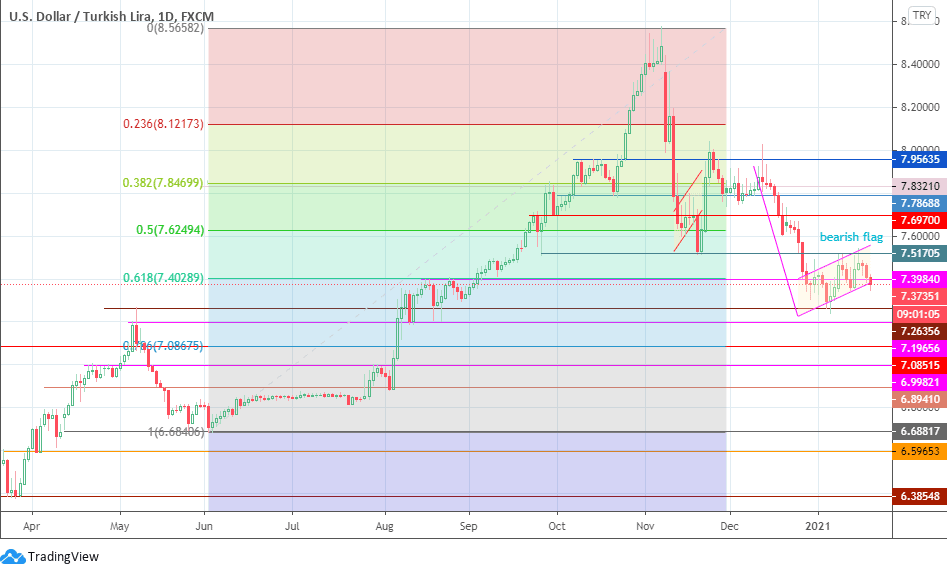

Technical Outlook for USDTRY

The intraday violation of the bearish flag pattern’s lower border has put the consolidation area at risk. A confirmation of the breakdown of the 7.39840 support is required. This scenario allows sellers to target the 7.26356 support line, with 7.19656 and 7.08515 lining up as targets to the south. These targets could be taken out if the race to the price projection of 6.99821 goes ahead.

On the flip side, failure to breakdown the flag consolidation area could allow for a recovery towards 7.51705, with 7.69700 and 7.78688 serving as additional upside targets. This move would invalidate the bearish expectation of the pattern.

USDTRY Daily Chart