- Summary:

- USDMXN has risen after the Mexico unemployment rate figure came in at 3.6%, which was a tad higher than what the markets were expecting.

The Mexico unemployment rate figure for August came in at 3.7%, which was in line with what markets had expected. However, it represented a worsening of the Mexico unemployment rate as the last figure recorded came in at 3.5%. As a result, the USDMXN has ticked higher and is currently trading at 19.5842.

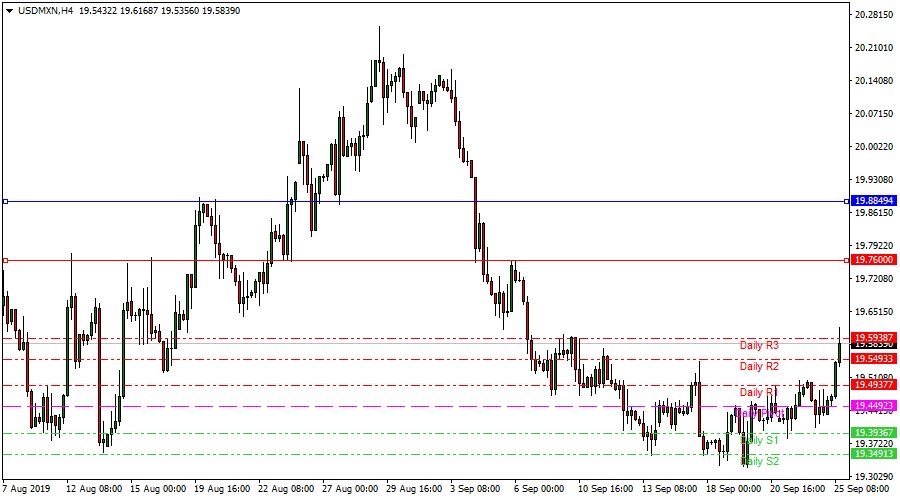

With this price move, the Mexican Peso has weakened significantly on the day. The USDMXN pair has broken above yesterday’s highs of 19.5047. It is now challenging the R3 pivot of 19.59387, having broken above R1 and R2. The R3 pivot has been tested once, with a slight pullback.

In the near-term, the USDMXN would have to contend with the R3 pivot price (September 10 high) as immediate resistance. If USDMXN is able to break above this resistance, it would open the door to 19.7590 (Aug 14 and Sep 5 highs) and above this level, 19.8880 (Aug 20 high) comes into focus.

The bullish outlook would be invalidated if price is unable to breach the current resistance, which would bring 19.54933 (R2 pivot and Sep 11 high in role reversal) into focus.