- Summary:

- USDMXN recovers earlier losses from 19.6520 after worse than expected Mexico retail sales. Mexico Retail Sales (year over year) came in at 1%, below

USDMXN recovers earlier losses from 19.6520 after worse than expected Mexico retail sales. Mexico Retail Sales (year over year) came in at 1%, below forecasts of 2% in June, the monthly reading also came down to -0.5% in June from previous 0.7%. Last week the Bank of Mexico cut interest rates for the first time since 2014 by 25 basis points to 8%. Many analysts believe that Banxico will continue in that direction with two more 25bp rate cuts before the year end. In United States the MBA mortgage applications for w.e.16 August dipped at -0.9% from previous +21.7%..

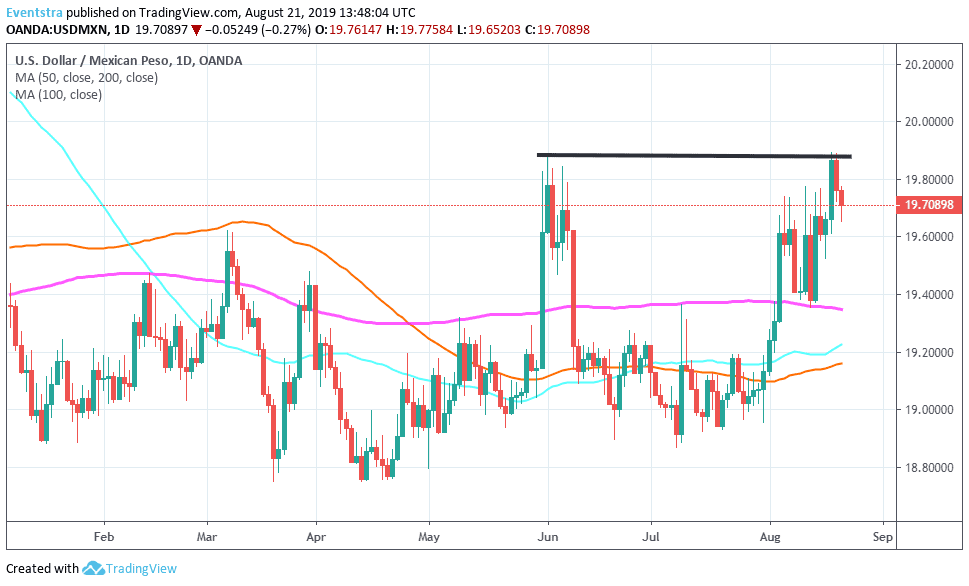

On the technical side the bulls are in control at least for the short term as the pair trades above all daily moving averages. On the upside first resistance stands at 19.8763 yesterday’s high, a point where the pair rejected in the last three attempts to break higher. In the case of a break higher, extra offers will emerge at the 20.1220 the high from December 20th 2018. On the downside immediate support for the pair stands at 19.6520 today’s low and then at 19.35 the 200 day moving average; Patient buyers will wait to enter long positions at 19.16 the 50 day moving average. Long positions sit comfortably as long as the pair holds above 19.50.