- Summary:

- USDMXN is adding 0.11 percent to 19.2164 having hit earlier today the low at 19.16 amid USD weakness across the board after FED changed its rhetoric

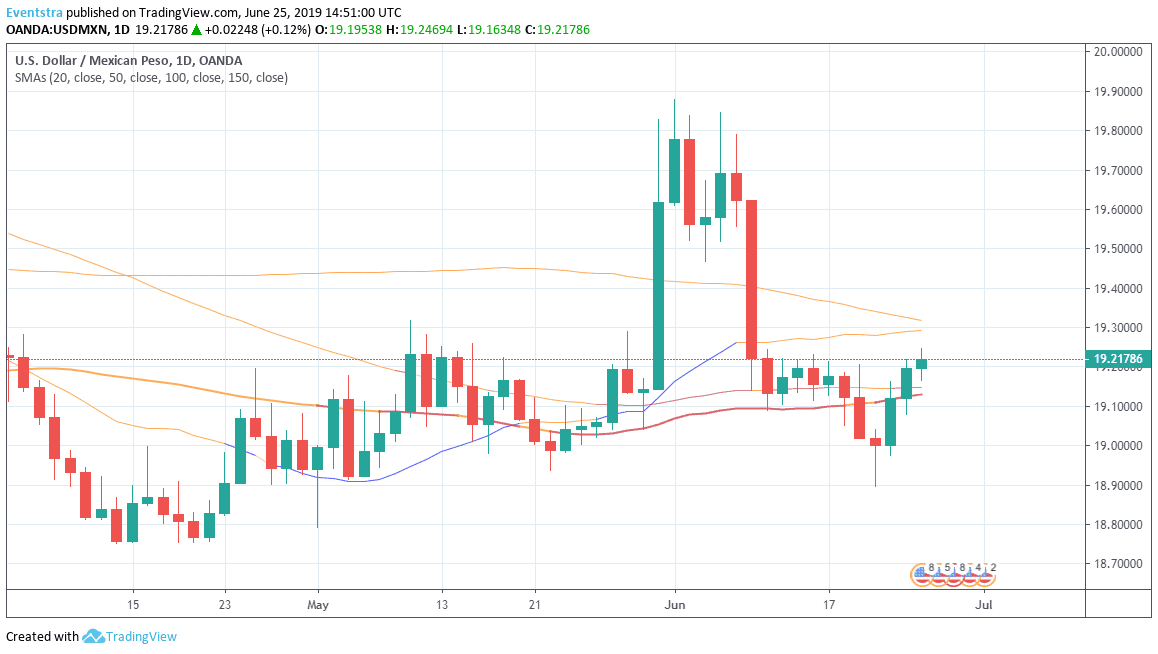

USDMXN is adding 0.11 percent to 19.2164 having hit earlier today the low at 19.16 amid USD weakness across the board after FED changed its rhetoric last Wednesday to more dovish, opening the door to 2 or 3 interest rate cuts before the end of the year. Macro data from USA failed to impress USD investors as The New Home Sales Change (Month on Month) came in -7.8% lower at 0.626M below economist’s forecasts of 1.9% and 0.68M for May. The United States Richmond Fed Manufacturing Index came in at 3 below analyst’s forecasts of 5 for June. The consumer confidence weakened in June with the headlines Confidence Index dropping to 121.5 in June from 131.3 in May.

The pair yesterday broke above the 50 day moving giving the bulls the upper hand for the short term. The pair tested the support at 18.89 on Friday and managed to rebound above the 19.00 zone from the beginning of the week. The technical picture for the pair starts to improve and an attempt higher can’t be ruled out. Immediate support for the pair stands at 19.14 the 100 day moving average while more solid buying will emerge at year today low down to 18.89. On the upside first resistance stands at the 20 day Moving Average at 19.29 while extra offers will emerge at the 19.3175 mark where the 150 day moving average crosses.