- Summary:

- The Mexico Consumer Confidence came in at 106.1, worst than analysts’ expectations of 109.9 for June. USDMXN is giving up 0.11 percent to 18.9979 having

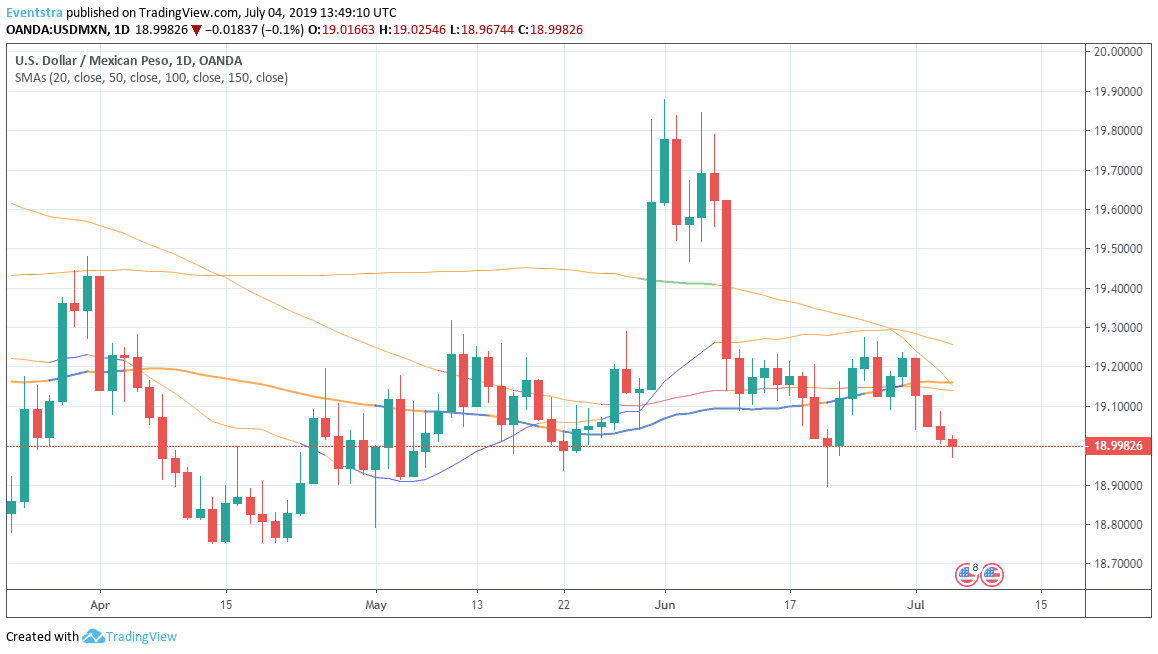

The Mexico Consumer Confidence came in at 106.1, worst than analysts’ expectations of 109.9 for June. USDMXN is giving up 0.11 percent to 18.9979 having hit earlier today the low at 18.967. Macro data from USA failed to impress USD investors yesterday, the US initial jobless claims for the week of June 29th came in at 221,000 versus forecasts of 223,000 the prior week revised higher to 229,000 versus 227,000. The 4 week average came at 222.25K versus 221.75K. The Continuing Jobless Claims came in at 1.686M, beating analysts’ forecasts of 1.675M for June 21. The U.S. Trade Balance recorded at $-55.5B worst than analysts’ expectations from $-54B in May. The US exports increased by 2.0% while the Imports increased by 3.3%. The US China May deficit was at $30.2B vs $26.9B before.

The pair breached today the 19 figure and despite worst macro data from Mexico the pair is under selling pressure. The technical picture for the pair is bearish and an attempt lower can’t be ruled out. Immediate support for the pair stands at 18.8937 the low from June 20th while more solid buying will emerge at year today low down to 18.75 from April. On the upside first resistance stands at the 100 day Moving Average at 19.1407 while extra offers will emerge at the 19.2563 mark where the 150 day moving average crosses.Don’t miss a beat! Follow us on Twitter.