- Summary:

- USDMXN is adding 0.32 percent to 19.1827 ahead of the FOMC policy decision with most economists expect now 3 cuts of 25bps each at the July, September

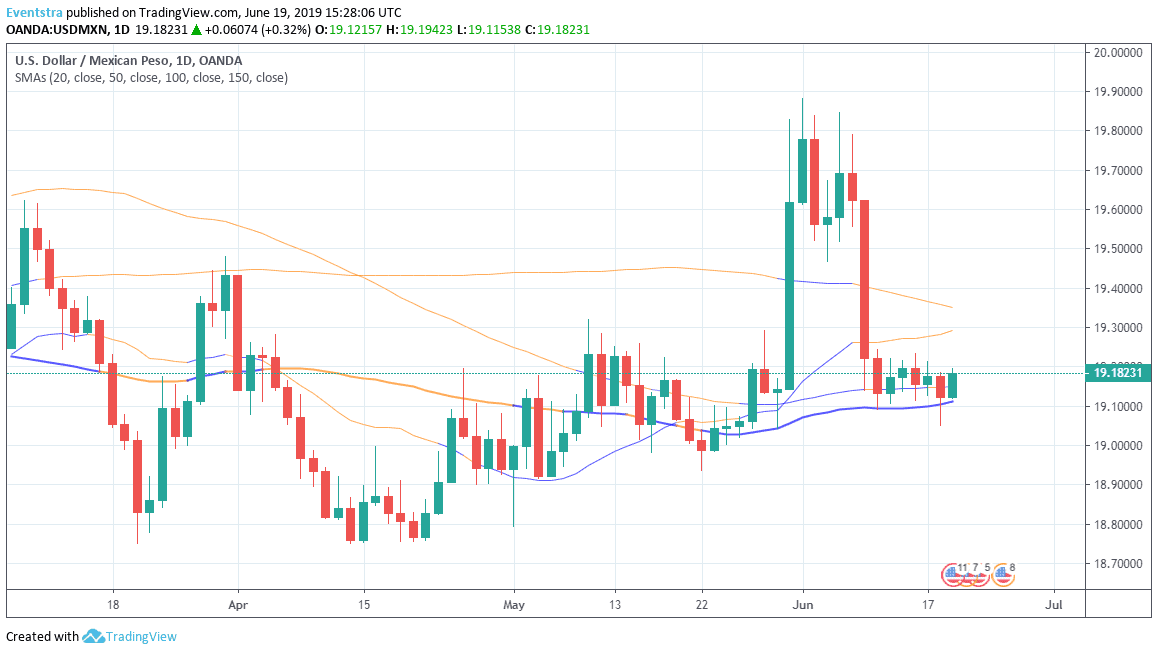

USDMXN is adding 0.32 percent to 19.1827 ahead of the FOMC policy decision with most economists expect now 3 cuts of 25bps each at the July, September and December meetings. The economic growth in Mexico is deteriorating, amid slower economic activity in the USA, a tight fiscal stance and a persistent weakness in private investment. In June, Fitch Credit rating downgraded Mexico’s and Pemex’s sovereign ratings, while Moody’s update the outlook to negative.

The pair today managed to break above all major hourly moving averages giving the bulls the upper hand until the FED decision later today. The pair found support at 19.11 the 50 day moving average an area that tested three times before and went back into the range between 19.10 and 19.20 that has been in place for over a week now. The picture is neutral for the pair and now that the tariffs issue has resolved the pair might go back where all the rumors about the tariffs started around 18.90 zone back in May. Immediate support for the pair stands at 19.15 the 50 hour moving average while more solid buying will emerge at previous monthly low down to 1.1901. On the upside first resistance stands at the 20 day Moving Average at 1.1929 while extra offers will emerge at the 1.1934 mark where the 150 day moving average crosses.