USDMXN is giving 0.05 percent to 19.0097 having hit earlier today the low at 19.89 amid USD weakness across the board after FED changed its rhetoric to more dovish, opening the door to 2 or 3 interest rate cuts before the end of the year. Macro date from USA failed to impress USD investors as the initial jobless claims fell by 6,000 to 216,000 for the week ended June 15, and the Philadelphia Fed manufacturing index fell to just 0.3 in June worst than analyst’s expectations.

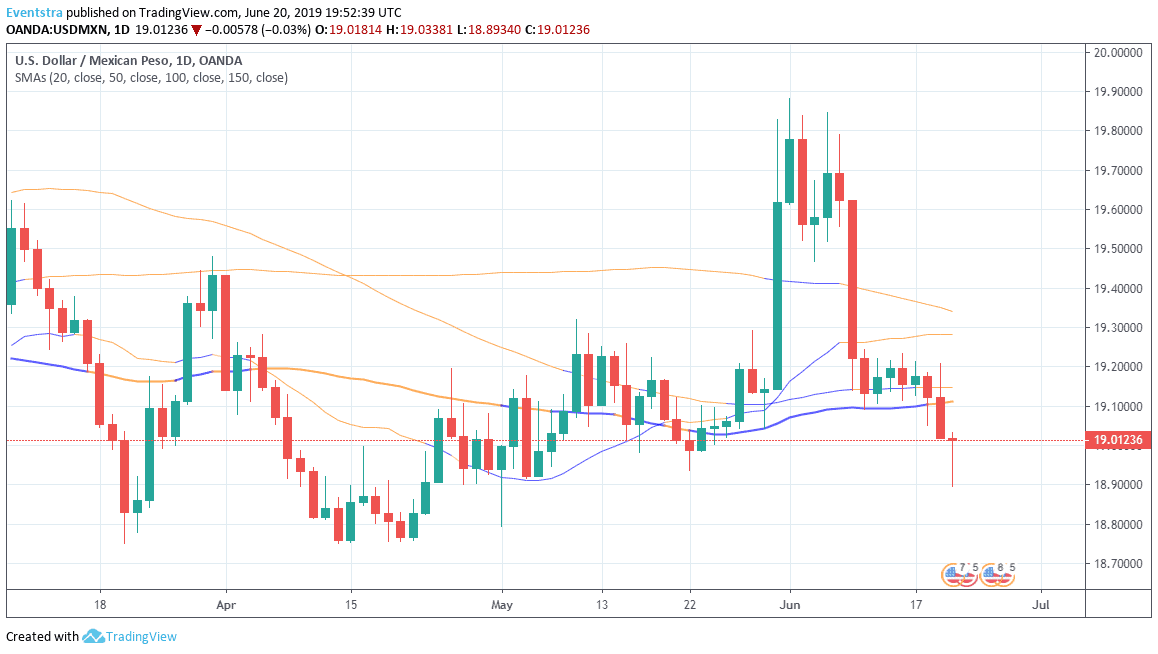

The pair yesterday broke below the 50 day moving giving the bears the upper hand. The pair tested the support at 18.89 and managed to rebound above the 19.00 zone before the end of U.S trading session. The picture is bearish for the pair and now that the tariffs issue has resolved the pair might go back where all the rumors about the tariffs started around 18.90 back in May. Immediate support for the pair stands at 18.89 while more solid buying will emerge at year today low down to 19.74. On the upside first resistance stands at the 50 day Moving Average at 19.11 while extra offers will emerge at the 19.34 mark where the 150 day moving average crosses.