- Summary:

- Banco de México Governing Board has decided by majority to maintain the target for the overnight interbank interest rate at 8.25%.

Banco de México Governing Board has decided by majority to maintain the target for the overnight interbank interest rate at 8.25%. One member of the policy committee voted to reduce the target by 25 basis points. Considering the challenges to consolidate a low and stable inflation as well as those the economy’s price formation is subject to and the amount of slack in the economy, the Bank Of Mexico will continue to follow closely all factors and elements of uncertainty that have an impact on inflation and its outlook and will take the necessary actions based on information so that the interest rate policy is consistent with the orderly convergence of headline inflation to Bank Of Mexico’s target within the time frame in which monetary policy operates.

Recent threats from U.S. to impose tariffs on imports from Mexico, increases the risks to Mexican economy, although this risk has decreased as a result of the recent agreement. Other risks are that energy prices revert their downward trend or that agricultural and livestock product prices exhibit increases; that public finances deteriorate; that core inflation’s persistence influences medium- and long-term inflation expectations by making them show a greater resistance to decline; and, that global protectionist measures escalate.

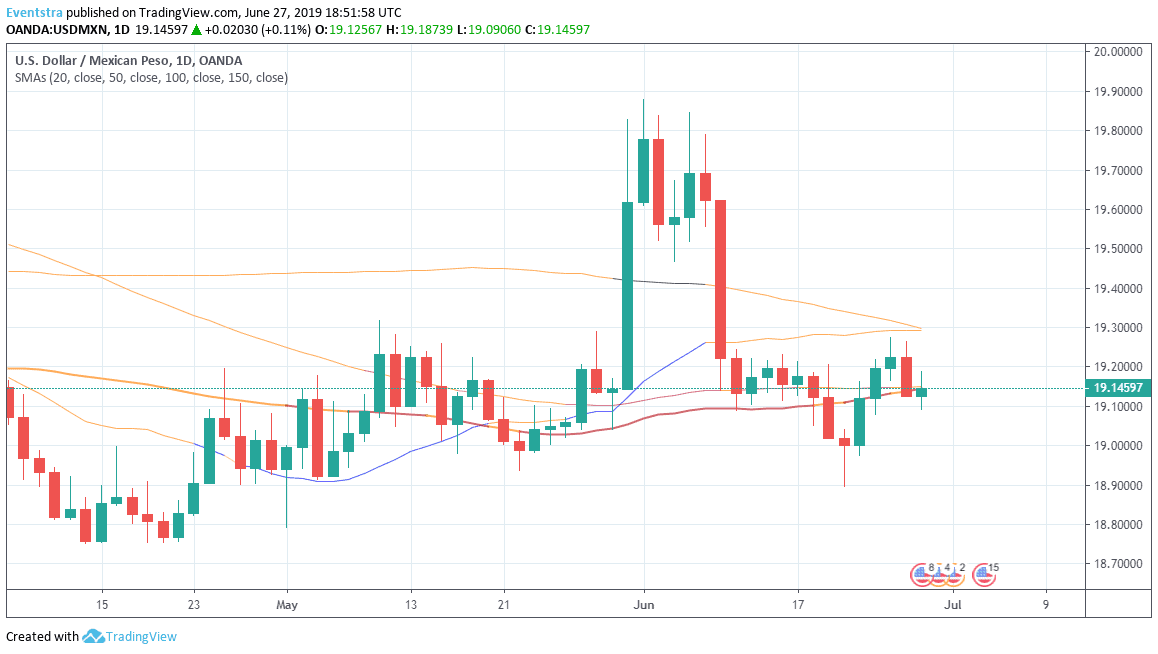

USDMXN is adding 0.11 percent to 19.2164 having hit earlier today the low at 19.090. Fed changed its rhetoric last Wednesday to more dovish, opening the door to 2 or 3 interest rate cuts before the end of the year. Macro data from USA failed to impress USD investors earlier today.

The pair is trading today around the 50 day moving average. The technical picture for the pair starts to improve and an attempt higher can’t be ruled out. Immediate support for the pair stands at 19.14 the 100 day moving average while more solid buying will emerge at year today low down to 18.89. On the upside first resistance stands at the 20 day Moving Average at 19.2926 while extra offers will emerge at the 19.2998 mark where the 150 day moving average crosses.Don’t miss a beat! Follow us on Twitter.