- Summary:

- Immediate support for USDJPY stands at 105.11 today’s low while extra bids will emerge at yesterdays low at 105.00 round figure and then at 104.62

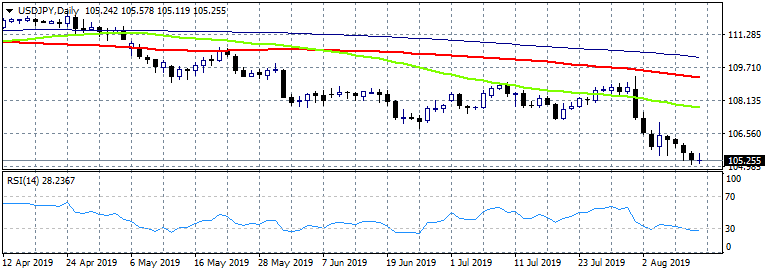

USDJPY trades 0.04% lower at 105.24 close to 16 month lows having hit the daily low at 105.11. Japan July preliminary machine tool orders came in at -33.0% (y/y) versus -37.9% previous reading. Risk off sentiment drives the pair as investors turn to safe haven assets such as yen and gold.

Immediate support for the pair stands at 105.11 today’s low while extra bids will emerge at yesterday’s low at 105.00 round figure and then at 104.62 the low from March 18th 2018. On the upside first resistance stands at 105.57 the daily high and then at 105.74 the 100 day moving average. The 106.00 mark is a critical level now, long positions can be opened as long as the pair trades above that figure chasing a rebound, but stop loss orders must be placed at 105.80 as if the pair breaks below, offers will step in and push the price to recent lows. The RSI index in the daily chart rebounded from the 30 mark to 45 and avoided the oversold level, giving a reversal signal.