- Summary:

- USDJPY trades 0.05% lower today after United States Initial Jobless Claims came in at 215K above expectations of 214K in July 26; the Initial Jobless Claims

USDJPY trades 0.05% lower today after United States Initial Jobless Claims came in at 215K above expectations of 214K in July 26; the Initial Jobless Claims 4-week average dipped from previous 213K to 211.5K in July 26. Continuing Jobless Claims came in at 1.699M, above expectations (1.678M) in July 19.Yesterday Fed delivered the 25 bp interest rate cut that markets expecting and the USD rallied across the board. Earlier this week BOJ left its interest rate policy unchanged, as widely expected, and maintained its guidance of extremely low rates at least through spring next year. The Bank of Japan added it would ease “without hesitation” if the economy growth loses momentum for achieving the BOJ’s 2% inflation target. Japanese government revised downward the GDP growth for 2019 from 1.3% to 0.9%; for FY 2020 real GDP growth estimate stands at 1.2%, while for 2019 consumer inflation estimate stands at 0.7%.

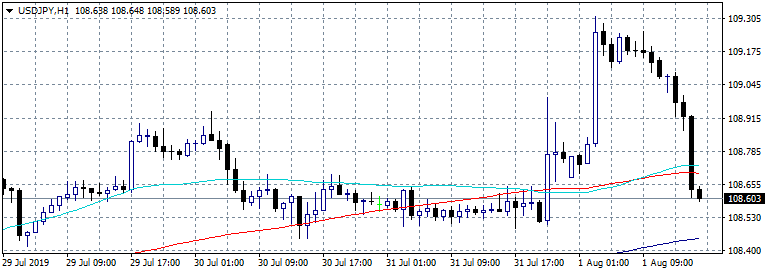

USDJPY started strong the day hit the daily high at 109.31 but after the jobless claims data the pair turned lower giving up all the gains and breaks below the 109 mark. Immediate support for the pair stands at 108.44 the 200 hour moving average while extra support will be met at 108.28 the 50 day moving average. On the upside first resistance stands at 109.31 the daily high and then at 109.63 the 100 day moving average while a break above can drive prices up to 110.48 the 200 day moving average. The 109.00 mark is a critical level now, long positions can be opened as long as the pair trades above that figure but stop loss orders must be placed at 108.44 as if the pair breaks below sellers will step in. Bears can initiate a short position if the pair breaks below 108.44, targeting the 108 zone.Don’t miss a beat! Follow us on Twitter.