USDJPY trades 0.48% lower at 107.91 after the Bank of Japan left the interest rates policy unchanged as expected by markets. BoJ Governor H. Kuroda noted that Japanese economy is expanding moderately. The BOJ was not hawkish or dovish and offered no additional hints of potential easing. On the macro front the Japan July all industry activity index which came in at +0.2% in line with expectations

The pair hit the daily low at 107.78 and the daily high at 108.466. The central bank of China set the Yuan rate (USDCNY) at 7.0732 versus yesterday fix at 7.0728.

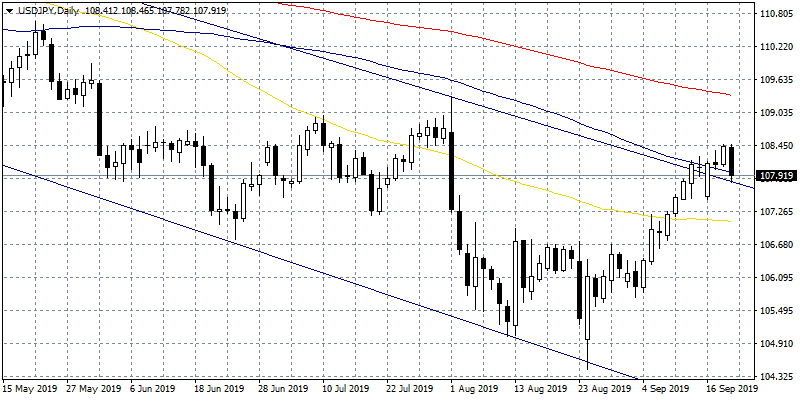

On the technical side, USDJPY finnaly retreats after eleven consecutive trading sessions as the rebound which started in August 26th from 104.44 lows stalled at 108.45 area. The pair today pierced the 100-day moving average and stopped at the upper bound of the descending channel. On the downside, immediate support for USDJPY stands at 107.78 today’s low while extra bids will emerge at 107.49 the low from September 16th.

On the upside first resistance stands at 108.46 the daily high, a convincing break above will attract more bids that can drive the prices up to 109.34 the 200-day moving average. Long positions might initiated if the pair closes above 108 for a break above the 108.45 recent highs, stop-loss orders must be placed at 107.78 as if the pair breaks below, offers will step in and might push the price down to 107. USDJPY technical picture is neutral now as the pair trades above the 50-day moving average and below the 100-day moving average.