- Summary:

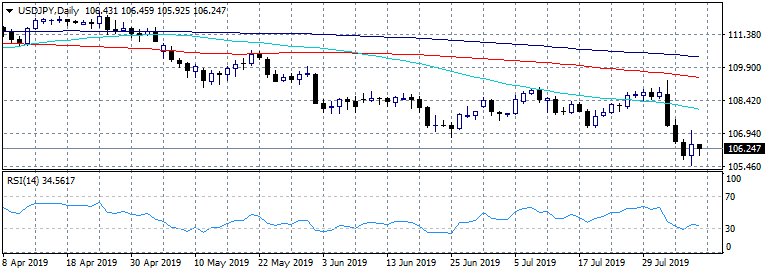

- USDJPY trades 0.22% lower at 106.22 but managed to rebound from the daily low at 105.92. The pair seesaws around the 50 hour moving average

USDJPY trades 0.22% lower at 106.22 but managed to rebound from the daily low at 105.92. The pair seesaws around the 50 hour moving average as the bears are in full control of the game. JP Foreign Reserves fell from previous $1322.3B to $1316.5B in July.

Immediate support for the pair stands at 105.92 today’s low while extra bids will emerge at yesterday’s low at 105.51. On the upside first resistance stands at 106.45 the daily high and then at 106.70 the 100 day moving average. The 106.00 mark is a critical level now, long positions can be opened as long as the pair trades above that figure chasing a rebound, but stop loss orders must be placed at 105.80 as if the pair breaks below sellers will step in and push the price to recent lows. The RSI index in the daily chart rebounded from the 30 mark to 34 and avoided the oversold level, giving a reversal signal.