- Summary:

- The Fed has cut US interest rates to 2%; the 2nd successive rate cut in a row. More volatility expected as Fed Chair speaks soon.

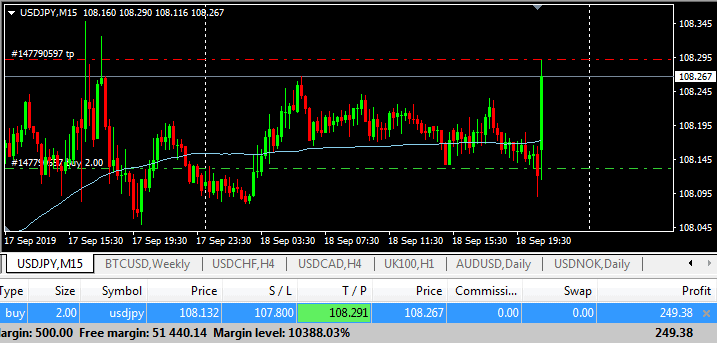

The USDJPY spiked in an initial response to the US Fed decision to cut interest rates to 2%. This latest reduction in the Fed Funds Rate is in line with market expectations. The US Dollar has gained across board in an initial spike move. The USDJPY climbed from 108.09 to a high of 108.29 on the initial move.

Recall from the preview written yesterday that the initial move was expected to be muted if the rate cut was in line with expectations. The real sauce will be in the statement by the US Fed Chair Jerome Powellin about 15 minutes from now.

Will he describe this rate cut as yet another “mid-adjustment cycle”, an “insurance cut” or will his press statements signal the opening of the floodgates of monetary easing going forward?

A follow-up to this story comes up later as we continue to watch the markets.

which in context, has really been more of a muted jump,