- Summary:

- USDJPY trades 0.04% higher at 105.76 as the inversion of the US yield curve to lowest level in 12 years pointing to US recession. On the USA data front the

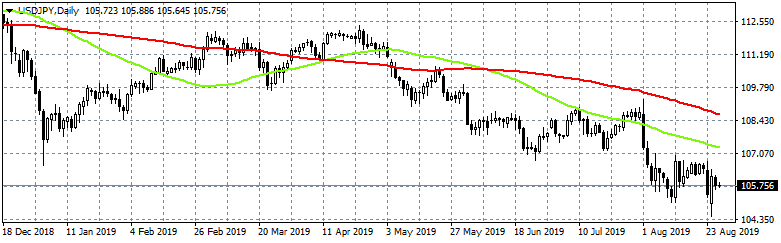

USDJPY trades 0.04% higher at 105.76 as the inversion of the US yield curve to the lowest level in 12 years pointing to US recession. On the USA data front, the US house price growth slowed in June, according to the S&P/Case-Shiller National Home Price Index. The pair hit the daily low at 105.64 and the daily high at 105.88. The central bank of China set the Yuan rate (USDCNY) at 7.0835 versus yesterday fix at 7.0810.

Immediate support for USDJPY stands at 105.64 today’s low while extra bids will emerge at 104.44 the low from August 23rd. On the upside, first resistance stands at 105.88 the daily high and then at 106.40 the high from August 23th. Long positions can be opened as long as the pair breaks above 105.88 today’s high for a break above 106, stop-loss orders must be placed at 105.64 as if the pair breaks below, offers will step in and push the price to recent lows. USDJPY technical picture is bearish and as trade war between US and China escalates investors will keep looking for safe-haven assets.

USDJPY: Safe Haven Yen in Demand

USDJPY: Safe Haven Yen in Demand