- Summary:

- Some positive news from the US-China trade impasse has helped the USDJPY recover ground it lost last week. USDJPY up nearly 120 pips on the day.

The US Dollar staged a massive rebound on Monday, gaining 120 pips as at the time of writing on positive vibes from the US and China amidst the US-China trade war.

The pair rebounded from the lowest levels seen in the last 3 years after President Donald Trump hinted that Beijing had made contact with Washington and indicated their willingness to return to the table for further negotiations. Over the weekend, the Chinese Vice Premier had also made remarks that indicated that China was ready to negotiate terms that would end the US-China trade impasse.

This was a welcome development that pleased traders with a risk appetite, after $500billion worth of Chinese goods were hit with a 5% tariff on Friday, spurring a risk-off sentiment that saw a massive selloff on the USDJPY pair. China had also slammed retaliatory tariffs on $75bn worth of US goods.

Technical Play on USDJPY

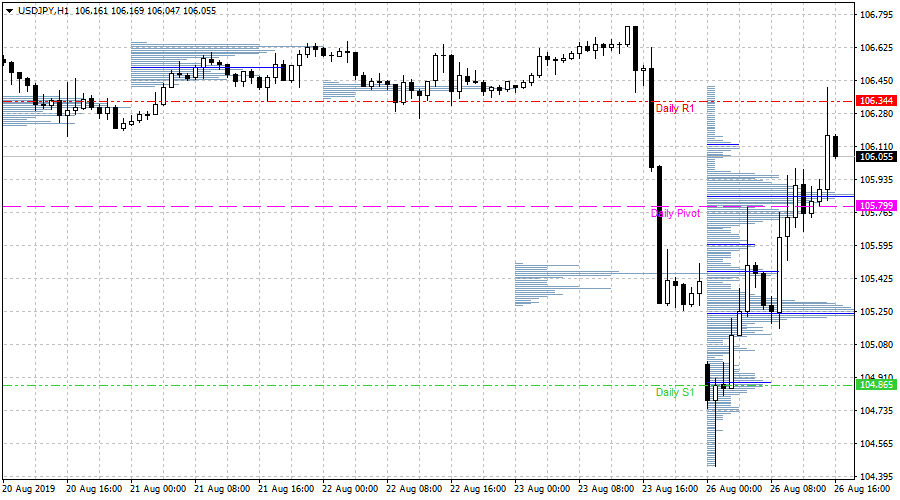

The intraday chart shows an interesting picture. Here, we see the formation of both a bullish flag and a bullish pennant, with very steep upside price movements. The pair had earlier attained the 106.34 resistance level (R1 pivot) but was beaten back at this level. The technical conclusion of the bullish pennant should see the present rally terminate at the R1 pivot. Therefore it is possible that price may make another dash for this price area, but not before retreating to the central pivot from where renewed buying interest may be found.

If price breaks the central pivot to the downside, this will invalidate the preceding view and point the way to the 105.26 minor support level.