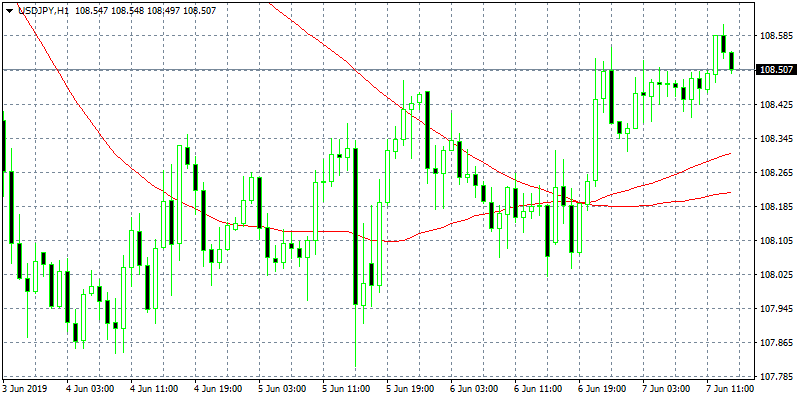

USDJPY started the European trading session on strong foot today, after the pair earlier this week hit multi month low below 108. As of writing the pair is trading at 108.50 very close to daily high as traders sentiment has improved. We are waiting the non-farm payrolls data from U.S. which will drive the markets today. Analysts expect that the US economy added 185K jobs in May and the jobless rate is forecasted at 3.6%. In Japan, the Leading Economic Index came in at 95.5, below expectations (96.1) in April and the Japan Overall Household Spending (YoY) came in below markets expectations (2.6%) in April: Actual (1.3%).

USD is under selling pressure this week as investor expectations that the Fed will eventually cut interest rates grow. The pair has broke below all key moving averages since the start of May as trade war between China and USA escalates, and never came even close, any attempts to the upside met strong offers. Immediate support for the pair stands at 108 round figure while solid support will be met at yearly low down to 107.60. On the upside resistance for today stands at 108.61 the daily high while key resistance will be met at 108.70 the 50 SMA in the 4 hours chart. The otlook for the pair has improved the last three trading sessions but the Bearish momentum is still intact and any strong gains for the pair is a selling opportunity.