- Summary:

- USDJPY is presently in consolidation as the markets await the release of the US Retail Sales and Core Retail Sales reports.

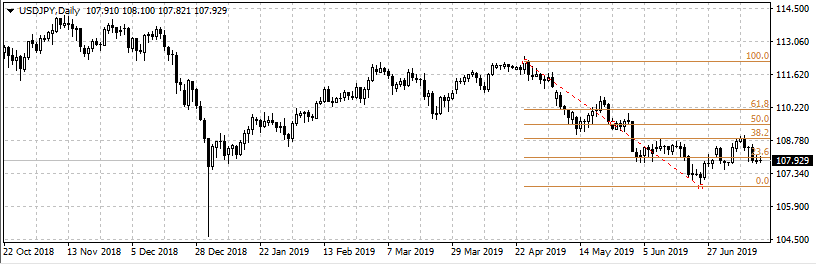

Last week, I made a trade call to sell the USDJPY at 108.40 – 108.45, with a 25-pip stop loss and a 50-pip profit target at 107.90. After the pair rallied to 108.61, it sold off to hit my profit target. The USDJPY has found itself locked in a renewed range in the last two sessions, with a ceiling of 108.10 (daily R1 pivot) and a floor of 107.76 (daily S1 pivot). This sideways trend will continue until the US Retail Sales report is released at 8.30am EST.

A recent sentiment survey conducted by IG, sets the ratio of long positions to short positions on the USDJPY as being nearly 2:1. Both the Retail sales and the core component of this report are expected by economists to have dropped to 0.1% for the month of June, down from the 0.5% level recorded in May. Coupled with the sentiment generated by the dovish comments from the US Fed Chari Jerome Powell, the USDJPY continues to maintain a bearish bias.

Possible Trade Ideas

If the report surprises to the upside, watch for a transient gain in the US Dollar up to the resistance pivot levels of 108.24 and 108.38. These are also the areas where we have the Fibonacci retracement levels of 38.2% and 50%, tracing from the daily swing high of July 9 to the swing low of July 10. Upside break of these levels will open the door for price to attain the 108.65 – 108.80 levels. These price moves may simply present an opportunity for medium term traders to sell on any rallies.

If the report surprises to the downside, then expect more selling on the USDJPY, targeting 107.5 – 107.62. Break of these support areas will open the door to 105.50.

Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.