- Summary:

- USD is recovering this week as investor expectations that the Fed will eventually cut interest rates digested. The pair has broke above the key 200 hour

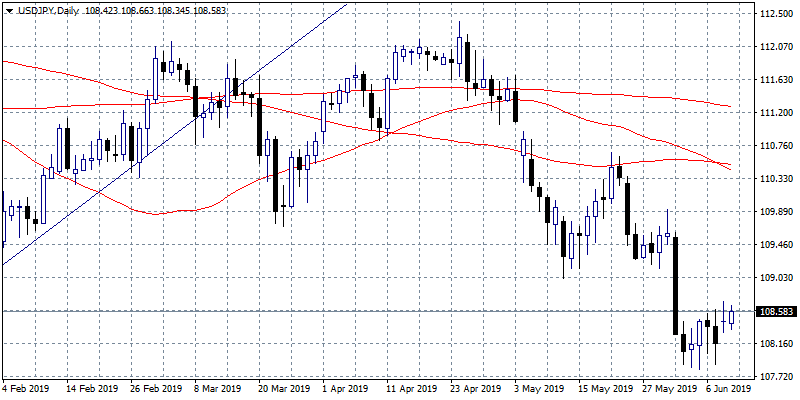

USDJPY started the European trading session on positive foot today, as the pair rebound from multi month low below 108. As of writing the pair is trading at 108.60 very close to daily high (108.66) as traders sentiment has improved. The announcement from President Trump to suspend the plan to impose tariffs on all Mexican imports helped improve the global markets risk sentiment and weighed on the Yen’s (JPY) perceived safe-haven status.

USD is recovering this week as investor expectations that the Fed will eventually cut interest rates digested. The pair has broke above the key 200 hour moving average yesterday and now the bulls are targeting the 108.72 weekly top which if breached can lead prices to 109 mark. Immediate support for the pair stands at 108.34 the low from Asian session while extra support will be met at 108 round figure and then at yearly low down to 107.60. The outlook for the pair has improved the last three trading sessions but the Bearish momentum is still intact and any strong gains for the pair is a selling opportunity.