- Summary:

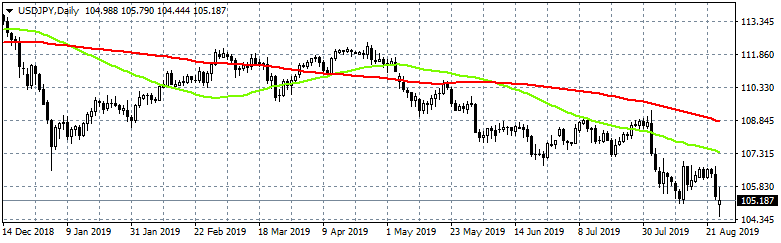

- USDJPY started sharply lower the week making fresh 3 year lows at 104.44 but managed to rebound above the 105 mark; investors turn to safe heaven assets

USDJPY started sharply lower the week making fresh 3 year lows at 104.44 but managed to rebound above the 105 mark; investors turn to safe heaven assets such as Yen amid trade war escalation between US and China. Earlier today, Japan Leading Economic Index came in at 100.4 beating forecasts of 93.3 in June. Japan June final leading indicator index came in at 93.3 as per expectations.

Immediate support for USDJPY stands at 104.44 today’s low while extra bids will emerge at 102.53 the low from October 2016. On the upside first resistance stands at 105.79 the daily high and then at 106.08 the 50 hour moving average while extra offers will emerge at 106.27 the 100 hour moving average. Bears are in full control of the pair and every upside move will meet aggressive sellers. As risk off sentiment takes center stage in markets safe heaven assets like gold and Yen will attract investors bids.