- Summary:

- USDJPY continues north for sixth consecutive day amid broad USD strength as traders looking for a 25 basis point interest rate cut by Fed next week

USDJPY continues north for sixth consecutive day amid broad USD strength as traders looking for a 25 basis point interest rate cut by Fed next week. Tokyo inflation figures came out 0.1% topping expectations, Japan Tokyo Consumer Price Index (YoY) came in at 0.9% below forecasts of 1.1% in July

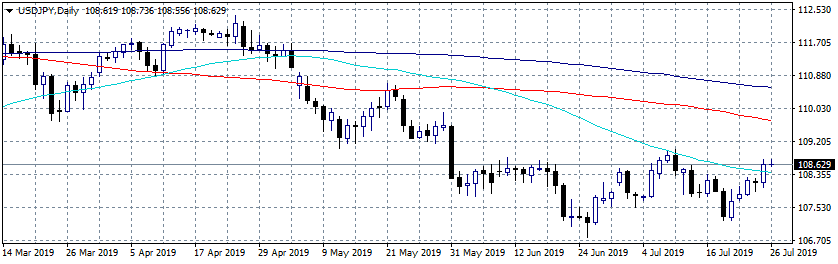

USDJPY managed to break above the 50 day moving average yesterday giving the bulls the upper hand for the short term. Immediate support for the pair stands at 108.31 the 50 hour moving average while extra support will be met at 108.04 the 200 day moving average. On the upside first resistance stands at 108.73 the daily high and then at 108.90 the high from July 10th while a break above can drive prices up to 109. The 108.43 mark is a critical level now, long positions can be opened as long as the pair trades above that figure but stop loss orders must be placed at 108.31 as if the pair breaks below sellers will step in.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.