- Summary:

- The USDJPY is adding to its gains as US Fed Chair Jerome Powell explains the Fed's measured rate cut to 2% in his post-rate decision press conference.

US Fed Chair Jerome Powell has begun his press conference stating the reasons for the FOMC’s action in easing rates to 2%. In his words as quoted by Reuters:

“Lowered interest rates to keep economy strong, provide insurance against risks.”

He also said that “job gains have remained solid in recent months,” and that “there are risks to the positive economic outlook.”

“We will need more rate cuts if there is a downturn…we are not on a pre-set course.”

“Will be carefully looking at economic data meeting by meeting…Fed is particularly monitoring global growth and trade developments,” Powell said.

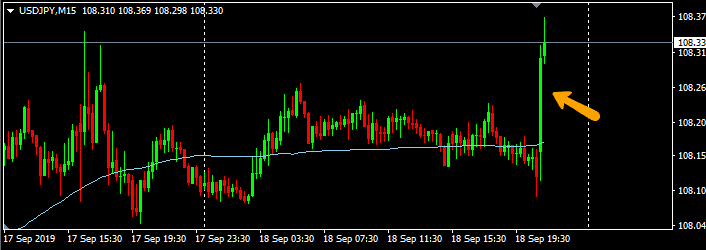

The markets seem to be loving what the Fed Chair is saying and the US Dollar is adding to its gains. It is now trading at 108.43, representing a 35 pip gain as at the time of writing.

However, not everyone seems impressed by the Fed’s move. In tweets just published, US President Donald Trump has blasted the rate cut as a failure on the part of the FOMC. He tweeted:

“Jay Powell and the Federal Reserve fail again. No “guts,” no sense, no vision!”

Surely, the last has not been heard and as markets digest this latest move by the Fed, expect more market volatility in the hours ahead.