- Summary:

- USDINR trades 0.55% lower at 70.912 making fresh 7-week lows after India’s Finance Minister Nirmala Sitharaman announced a cut to corporate tax rates for

USDINR trades 0.55% lower at 70.912 making fresh 7-week lows after India’s Finance Minister Nirmala Sitharaman announced a cut to corporate tax rates for domestic companies to 22%. Indian stocks jumped on the news with Nifty 50 adding over 5%. The Reserve Bank of India (RBI) lowered its benchmark interest rate by 35 basis points to 5.40% in its August monetary policy meeting, above analysts forecast of 25 basis points cut. The August cut was the fourth straight rate cut in 2019, in an attempt to boost Indias struggling economy. The Reserve Bank of India also lowered its growth forecast to 6.9% for 2020 from 7%.

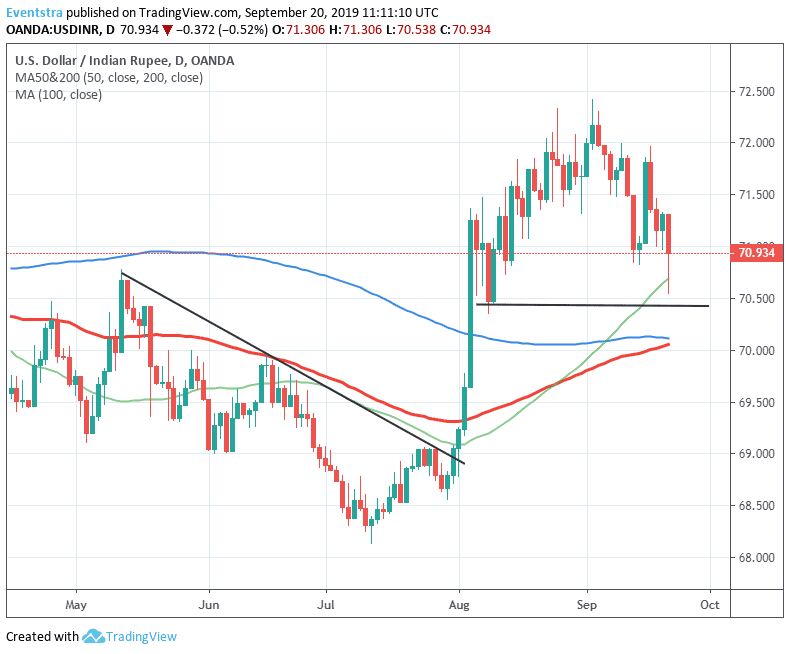

On the USDINR technical analysis side, the bears today attempted to regain control as they breached earlier the 200-day moving average around 70.693 but quickly corrected up to 70.94. On the downside, first support stands at 70.538 today’s low, while next barrier is at 70.118 the 50-day moving average. Investors holding short positions can sit comfortably as long as the pair trades below the 71 zone. On the upside immediate resistance stands at 71.306 today’s high, while a break above will open the way for a move up to 71.95 the high from September 20th, a convincing close above will open the way for a move to yearly highs at 72.428. For those looking to buy the pair, an entry point can be when the pair breaks above the daily top. Traders must be careful with USDINR as the recent developments with the corporate tax cut will affect the next moves for the pair.