- Summary:

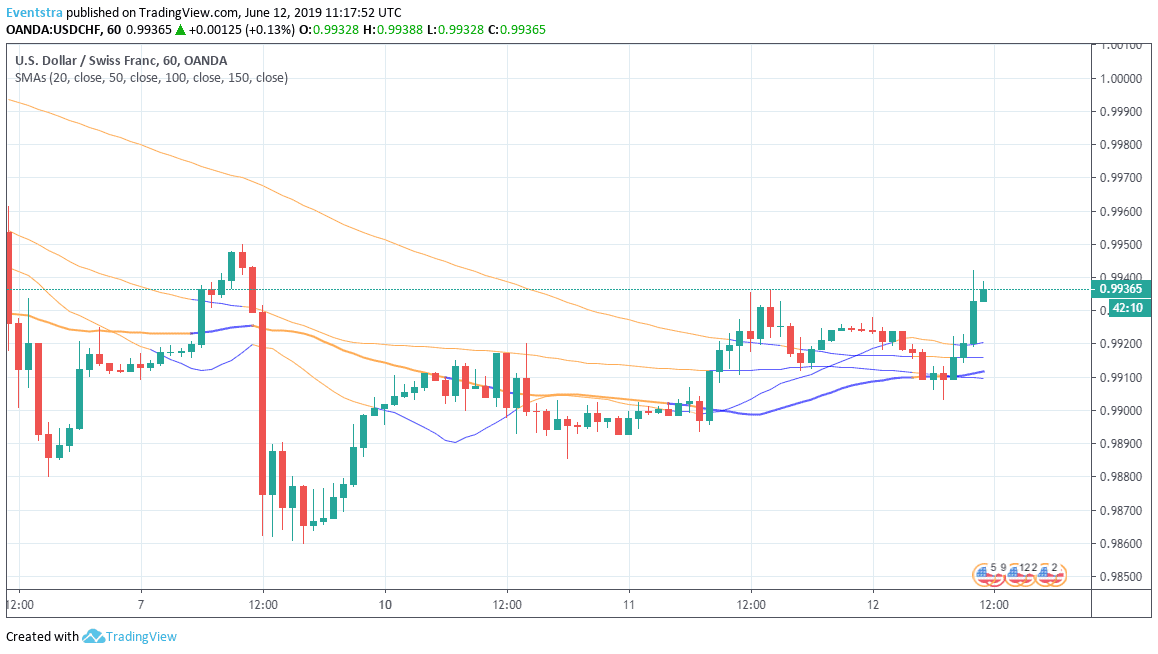

- USDCHF continues its trip north for third consecutive session reaching 0.9930 rebounding from the lows at 0.9850. The move today cancels the bearish outlook

USDCHF continues its trip north for third consecutive session reaching 0.9930 rebounding from the lows at 0.9850. The move today cancels the bearish outlook for the pair which sketched after traders convinced that the Fed will eventually move to more interest rates cuts by the end of 2019. Global trade worries also weighing on the USD and attracted bids for the Swiss Franc as it acts a safe haven asset.

As we have mentioned in our previous note the “USDCHF bulls need to regain the 0.99 mark just to gain a sign of life” and that is the fact today as the pair managed to break above 99 and also above the 50 and 100 hour moving averages. There are still several key resistance areas in the upside that pair needs to breach in order to establish a bullish trend. First is the 200 day moving average at 0.9964 and then the 150 day moving average at 1.0009 at the parity level. On the downside, a break below the 0.99 zone will extend the decline to recent low down to 0.9854. USD gains some positive momentum ahead of USA CPI and a better figure can give a boost to USD.