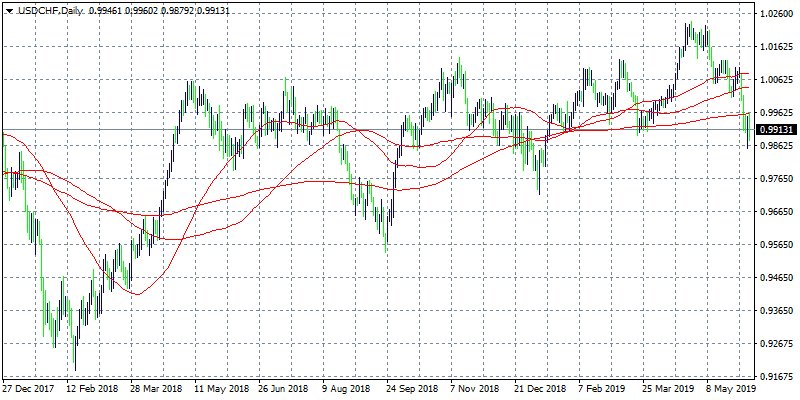

USDCHF is under heavy selling pressure after the pair breached the 50 hour moving average at 99.27 and now is trading close to daily low at 0.9886. The pair hit the daily low at 0.9879 and the high at 0.9960. The move today enhances the bearish outlook for the pair as traders convinced that the Fed will eventually move to cut interest rates by the end of 2019, coupled with the post-ECB spike in euro and weaker US economic figures. In its latest quarterly report, FED announced that the household debt in the U.S. rose at an annual rate of 2.3% to $15.7 trillion in the first quarter of 2019 following the 2.8% growth recorded in the last quarter of 2018.

Bulls need to regain the 0.99 mark just to gain a sign of life. There are several key resistance areas in the upside that pair needs to breach, first is the 200 day moving average at 0.9959 and then the 100 day moving average at the parity zone. On the downside, break of 0.9854 will extend the decline from 1.0237 to 0.9716 cluster support, the 50% retracement of 0.9186 to 1.0237 at 0.9712. USD looks vulnerable and any upside move should consider a selling opportunity.